China’s disappointing development slowdown weighs on markets; oil hits new highs – enterprise stay | Enterprise

9.33am BST

09:33

Matthew Moulding, the founder and chief executive of The Hut Group, is giving up his “golden” share of the company in an attempt to regain the confidence of the City after a sharp fall share in recent weeks.

The online retailer and tech services company said the cancellation of Moulding’s controlling share would promote “good corporate governance”, after a turbulent few weeks for the retailer’s stock price sparked by questions over its profitability, share structure and valuation.

THG’s share price

The Manchester-based group – which owns the online retail sites Lookfantastic, Glossybox, Zavvi and Coggles, as well as beauty brands including ESPA and Illamasqua – said the move would also help it apply for a premium listing in London, which it hopes to secure in 2022. Under current rules, Moulding’s golden share prevents a premium listing and therefore THG cannot be included in the FTSE.

Moulding said:

“After the anniversary of our 2020 listing we feel that the time is right to make this next step and apply to the premium segment in 2022, thereby continuing the development of THG as we endeavour to deliver our strategy for the benefit of our shareholders, key stakeholders and employees,”

Moulding’s controlling share was originally meant to give him ultimate control of the THG for up to three years, after it first floated on the London Stock Exchange in September 2020 with a £5.4bn valuation. The removal of the dual-class share structure is likely to appeal to investors whose holdings have significantly dropped in value in recent weeks.

Shares in THG jumped 8% to 312p on Monday morning after the announcement, giving it a market value of £3.5bn. Despite the rise, shares were still more than 50% lower than in early September.

9.19am BST

09:19

UK manufacturers hit back at claims firms are too reliant on foreign labour

The trade body for British manufacturers has hit back at ministers’ accusations that firms have relied for too long on cheap foreign labour, urging them to work in partnership with business instead of viewing it “as the enemy within”.

Make UK is calling on the government to recognise the challenges they are facing – including supply chain disruption and shortages of staff such as HGV drivers – rather than blaming them at a time when they are also facing soaring costs, including for energy and raw materials.

It is urging them to improve cooperation with industry to ensure companies can recover from Brexit and the pandemic, and enable firms to invest and grow over the next decade.

9.14am BST

09:14

Shanghai zinc soars to 14-year high as power crisis hits output

The Zinc powder production plant of Nyrstar in Balen, Belgium. Photograph: REX/Shutterstock

China’s power outages have driven the price of zinc to a 14-year high in Shanghai.

Worries about shortages amid the ongoing energy crisis pushed the November zinc contract on the Shanghai Futures Exchange up 8% to 27,720 yuan ($4,308.16) a tonne.

That’s the highest level since August 2007, for the metal used to rust-proof steel.

The three-month zinc price on the London Metal Exchange hit its highest since June 2007 last Friday.

Soaring energy prices have forced Belgium-based Nyrstar to cut production by up to 50% at its three European zinc smelters, while Glencore is cutting production at three zinc smelters in Europe.

Some of China’s smelters have also been ordered to cut output to save on energy, adding to metal supply cuts that are pushing up factory costs.

8.51am BST

08:51

Ford to invest £230m in electric vehicle plant on Merseyside

Photograph: Greg Harding/PA

Ford has announced it will invest £230m in a Merseyside transmission factory to upgrade it to make parts for electric vehicles, in a significant fillip for northern England’s automotive industry.

The US carmaker’s investment will help maintain about 500 jobs at the plant in Halewood, Knowsley, which currently makes transmission systems for petrol and diesel vehicles. Ford will receive UK government support worth about £30m, according to a source with knowledge of negotiations.

By 2024 the lines at the factory will produce 250,000 electric drive units, components that include electric motors and power electronics, every year.

Ford said in February that all the cars it sells in Europe will be electric by 2030. That matches up to the UK government’s plan to end the sale of pure petrol and diesel cars by 2030, and hybrids after 2035. The carmaker also intends to make two-thirds of commercial vehicle sales all-electric or plug-in hybrid by 2030.

Stuart Rowley, president of Ford of Europe, said Halewood would play an important part in its “very ambitious” plans, but said government action was needed to improve charging infrastructure. He also warned against a possible plan to cut the level of grants for electric cars.

“At Ford we’re all in.

In the industry we’ve made the decision, we’re going electric. But we need to significantly ramp up the infrastructure at home, in the workplace.”

Rowley also warned that shortages of computer chips that have dogged the global car industry for months are “here for a while, well into next year”.

Here’s the full story:

8.45am BST

08:45

Shares in Isle of Man-based gambling software business Playtech have surged 58%, after it agreed to a £2.7bn takeover by Australian slot machine firm Aristocrat.

The deal is worth 680p per share, or a 58.4% premium on Playtech’s closing price on Friday.

Rob Davies

(@ByRobDavies)

£2.1bn takeover of London-listed gambling software firm Playtech by Australia’s Aristocrat. More gambling/gaming convergence. https://t.co/k22p1Hmbdo

October 17, 2021

Playtech chief executive Mor Weizer said the deal will create “one of the largest B2B [business-to-business] gaming platforms in the world”

It comes amid a scramble of interest in UK gambling companies from overseas rivals, with William Hill acquired by the Las Vegas casino company Caesars, and Ladbrokes owner Entain receiving a takeover approach from DraftKings.

8.33am BST

08:33

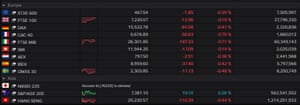

European markets have opened in the red, hit by the disappointing growth figures from China.

France’s CAC and Italy’s FTSE MIB have both lost around 0.7%, with Germany’s DAX down 0.4%

European stock markets, October 18 2021 Photograph: Refinitiv

The UK’s FTSE 100 is holding up better, though, down around 0.2% — with utilities, energy firms and miners rallying.

European stocks posted their best weekly gains in seven months on Friday – but the mood is a little gloomier this morning.

Richard Hunter, Head of Markets at interactive investor, says:

The bullish start to the week implied by futures markets this morning hasn’t materialized, as growth and inflation fears resurface.

China’s assets have led the tumbled, after weaker than expected GDP, industrial production and fixed asset investment provided a sobering reminder of the middle kingdom’s precarious economic position, which was compounded by a speech delivered by the PBOC Governor Yi over the weekend a cut to the RRR isn’t yet on the cards.

People’s Bank of China Governor Yi Gang said on Sunday that the recovery remains intact even though growth momentum has “moderated somewhat.”

Asia-Pacific markets have also sagged, as Victoria Scholar, head of investment at interactive investor, flags here:

Victoria Scholar

(@VictoriaS_ii)

#China data this morning:

Q3 #GDP 4.9% YoY, below estimates for 5.2%

Falls from Q2 7.9%, Q1 18.3%

Slowest pace of expansion in a year

China’s #growth target: 6%

Retail sales rose 4.4% in Sept, Industrial prod up 3.1% in Sept, both beating forecasts #Asia markets lower pic.twitter.com/tlw2aQQi1j

October 18, 2021

8.19am BST

08:19

The construction site of a highrise building in Beijing, China. Photograph: Thomas Peter/Reuters

New construction starts in China have fallen for the sixth month running, as Beijing’s clampdown on borrowing hits property developers.

China’s September new construction starts slumped for a sixth straight month, the longest spate of monthly declines since 2015, as cash-strapped developers put a pause on projects in the wake of tighter regulations on borrowing.

New construction starts in September fell 13.54% from a year earlier, the third month of double-digit declines, according to Reuters calculations based on data released by the National Bureau of Statistics toaty.

That’s the sixth monthly fall in a row, and the longest downturn since 2015.

Patrick Zweifel

(@PkZweifel)

#China construction activity contracted further in September (8.7% below trend) as both demand and supply for residential spaces declined (yet at a much slower pace) pic.twitter.com/SocQlhmxzI

October 18, 2021

Property sales by floor area dropped 15.8% in September, down for a third month, according to Reuters calculations.

Investments by property developers fell by 3.5% — the first monthly decline since January-February last year at the height of the COVID-19 pandemic in China.

“All the data are poor,” said Zhang Dawei, chief analyst with property agency Centaline.

“Financing is hard, sales are tough, so of course, there has been no enthusiasm to build. For the first time in history, developers are encountering two blockages – blockages in sales and blockages in financing.”

More here.

Reuters

(@Reuters)

China’s plunging construction starts reminiscent of 2015 downturn https://t.co/V9YtWby1G6 pic.twitter.com/5R77ByfNq0

October 18, 2021

8.06am BST

08:06

China’s slowdown: What the experts say

Jim Reid of Deutsche Bank says ‘multiple headwinds’ hit China’s economy:

GDP expanded in Q3 by +4.9% on a year-on-year basis, which is a touch below the +5.0% consensus expectation and a shift down from the +7.9% expansion back in Q2. That’s come as their economy has faced multiple headwinds, ranging from the property market crisis with the issues surrounding Evergrande group and other developers, an energy crisis that’s forced factories to curb output, alongside a number of Covid-19 outbreaks that have led to tight restrictions as they seek to eliminate the virus from circulating domestically.

Industrial production for September also came in beneath expectations with a +3.1% year-on-year expansion (vs. +3.8% expected), though retail sales outperformed in the same month with +4.4% year-on-year growth (vs. +3.5% expected), and the jobless rate also fell back to 4.9% (vs. 5.1% expected).

Patrick Zweifel

(@PkZweifel)

#China industrial production weakened further in September below trend 👇while retail sales slightly rebounded, remaining 8% below pre-crisis trend👇 pic.twitter.com/YnCunh6BNd

October 18, 2021

Julian Evans-Pritchard, senior China economist at Capital Economics, said his consultancy’s “activity proxy” measure now pointed to a “sharp contraction” in GDP.

“Although some of the recent weakness in services is now reversing, industry and construction appear on the cusp of a deeper downturn.

“For now, the blow from the deepening property downturn is being softened by very strong exports. But over the coming year, foreign demand is likely to drop back as global consumption patterns normalise coming out of the pandemic and backlogs of orders are gradually cleared. All told, we expect growth of just 3% on our China activity proxy next year, the slowest pace since the global financial crisis.”

Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd has cut his full-year growth forecast to 8% from 8.3%, warning that:

“The outlook remains vulnerable with power shortages and property curbs.

Helen Qiao, chief Greater China economist at Bank of America Corp, told Bloomberg TV that:

“The investment side of demand is pretty weak, and the power crunch impact on the supply side is also pretty severe.”

7.57am BST

07:57

Brent crude oil hits three-year high

The oil price has hit fresh highs this morning, despite China’s slowdown.

Brent crude touched $86 per barrel for the first time since October 2018.

The Brent crude oil price Photograph: Refinitiv

US crude is trading at a fresh seven-year high, over $83 per barrel.

The oil price has been lifted by increased demand as economies reopen, and tight supplies, while the urging gas prices is leading power companies to burn more oil instead.

Analysts from ANZ bank said in a note on Monday that:

“Easing restrictions around the world are likely to help the recovery in fuel consumption.”

The approach of the Northern Hemisphere winter is also lifting demand.

7.46am BST

07:46

Introduction: China’s economy slows as risks rise

Workers producing adhesive tapes for flexible printed circuits at a factory in Yancheng in China’s eastern Jiangsu province. Photograph: AFP/Getty Images

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Beijing has warned that economic risks have risen at home and abroad, after China’s economic growth was dragged down by power shortages and its housing crunch.

China’s GDP grew by just 0.2% in July-September, new figures this morning show, the weakest quarterly growth on record.

That dragged growth over the last year down to just 4.9%, down from 7.9% in the previous quarter, and worse than expected.

The slowdown highlights that China is still struggling after the coronavirus pandemic, amid a slew of problems at home and abroad — from power outages and supply bottlenecks to ongoing Covid outbreaks and concerns about the struggling property sector typified by the Evergrande crisis.

The GDP report shows a worrying loss of momentum — industrial production grew just 3.1% year-on-year in September, rising just 0.1% during the month.

Growth in Fixed Asset Investment slowed to 7.3% from 8.9%.

Fu Linghui, spokesperson for the National Bureau of Statistics, told a press conference Monday that:

“After entering the third quarter, risks and challenges at home and abroad increased with the pandemic continuing to spread and the recovery of the world economy slowing down.”

ACEMAXX ANALYTICS

(@acemaxx)

#China GDP in 3Q2021: +4.9%Y (expected: +5.2%) and IP (industrial production): +3.1% in Sept, chart @CNBC https://t.co/uT2UYkNoL8 pic.twitter.com/htqekzqaGT

October 18, 2021

China’s energy crunch has hit manufacturing growth. Recent power shortages led to rationing – causing some factories to shut down — prompting Beijing to order coal mines to increase production and plan to build more coal-fired power plants

Surging commodity costs have also hit manufacturing, pushing up factory gate inflation as manufacturers have passed on those costs.

Javier Blas

(@JavierBlas)

CHINA ENERGY CRUNCH: Massive electricity shortages in September contributed to knock down economic growth in China in Q3, with annual GDP growth slowing down to 4.9% (of course, many other factors at play, not just power shortages) https://t.co/tgjlpm2swE

October 18, 2021

China’s CSI 300 stock index fell by 1.3%, with concerns over Evergrande also hitting the real estate sector.

My colleague Martin Farrer explains:

The world’s second-largest economy has staged an impressive rebound from the pandemic but the recovery is losing steam. Problems including faltering factory activity, power cuts in the country’s crucial northern industrial heartland, and a slowing property sector have fanned speculation that policymakers may announce more stimulus measures in coming months.

Chief among the concerns about the giant property sector is the future of China Evergrande Group, the country’s number two developer which is struggling under a $300bn mountain of debt.

It has already missed three repayments on bonds that it owes overseas investors in US dollars, and trade in its shares in Hong Kong has been suspended since 4 October.

The crisis could reach a head this week when the 30-day grace period is up on the first tranche of repayments – worth $83.5m – that were missed in September .

But the head of China’s central bank, Yi Gang, said on Sunday the economy was “doing well” although it faced challenges such as default risks for certain firms due to “mismanagement”.

Reaction to follow…

The agenda

- 2.15pm BST: UK industrial production report for September

- 3pm BST: NAHB housing market index (US) for October