third Annual Franchise Advertising Report (AFMR), Half 3

Editor: This is the third part in a series of highlights of the annual Franchise Marketing Report (AFMR) 2021. You can find part 1 here and part 2 here.

The third annual Franchise Marketing Report (AFMR) was published in 2021. This report provides franchise consumer marketers with invaluable data and analysis to help them compare their performance against other franchise brands and within their industry. In short, the AFMR is a unique resource that franchise marketers can use to improve the effectiveness of their marketing efforts and spending.

The ongoing pandemic, in addition to the already competitive and foaming landscape of franchising, has increased the need for marketers to better understand how their brand is doing against the competition and how it is doing in the broader marketplace. The AFMR can help franchise consumer marketers understand how their team compares to their peers and, more importantly, help them direct their limited resources into the most effective channels to achieve their system-wide goals during these uncertain times to reach.

“This annual report was produced at the request of our Franchise Marketing Leadership Conference Advisory Board to develop relevant content for CMOs and learn more about their needs and challenges,” said Diane Phibbs, executive vice president and chief content officer, Franchise Update Media.

The AFMR participants consisted of franchise marketing executives who completed a detailed questionnaire. The responses were aggregated and analyzed to provide an in-depth look at the marketing practices, budgets and strategies of a wide cross-section of franchise brands and sectors. The data and the accompanying comments and analyzes form the basis of the AFMR 2021. Below is the third part in a series of selected highlights from the new report.

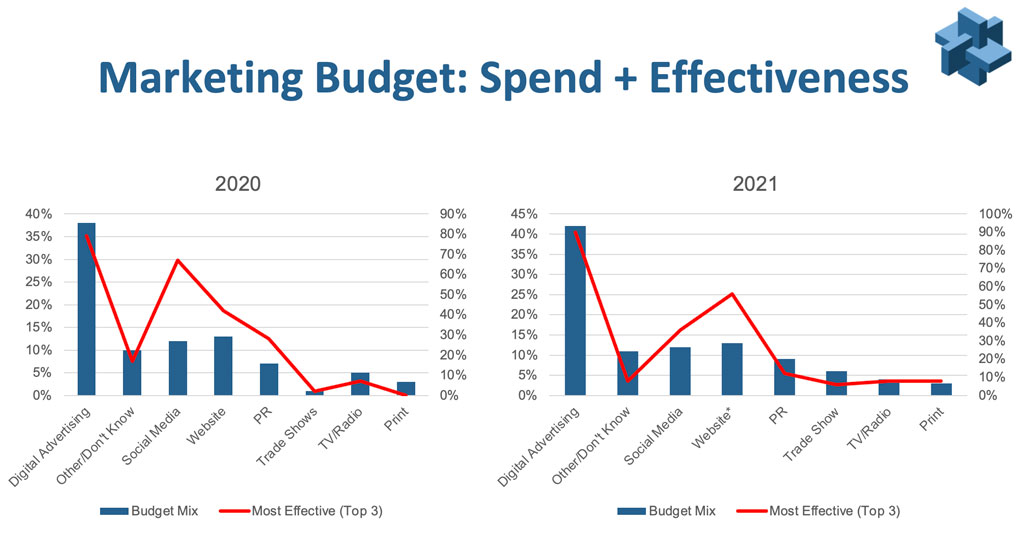

Marketing Budget: Spending and Effectiveness

The new consumer behavior as a result of the pandemic meant that media options that worked in the past were no longer as effective as in previous years. So where to spend? With so many people working from home, laid off, or on extended unemployment benefits, outdoor advertising like billboards and radio advertising has fallen to the end of marketers’ toolboxes.

Overall, two-thirds of respondents (67%) said budgets this year are higher than last year, although budget allocations remained similar to 2020 with a few exceptions.

Digital marketing spend increased, again unsurprisingly, as consumers spent more time online and made it easier to follow digital marketing efforts. As a result, online marketing methods such as digital advertising, websites, and social media have all done well over the past year. The digital effectiveness has increased significantly compared to the previous year, as the graphic shows.

And before the recent spread of the Delta variant, marketers had begun increasing their in-person trade show spending again. With business professionals longing to return to face-to-face (or at least elbow-to-elbow) meetings, it is not surprising that this area has become more effective.

Spending on television and radio fell by a few percentage points last year. Much of that decline was likely on the radio as marketers withdrew their dollars when commuters were told to stay home. “What is interesting here is that while spending in this category has decreased, its effectiveness has almost doubled from 2020,” said Phibbs.

Next time: Digital Marketing Budget: Spending and Effectiveness.