UK home value progress slows in ‘cooling market’ after pandemic growth – enterprise reside | Enterprise

9.39 a.m. BST

09:39

The FTSE 100 sagged a little more – today it’s down 0.2%.

But at the top of the London Stock Exchange this morning it says … the London Stock Exchange.

The owner of the London stock market is up 3.9% after posting an operating profit of $ 1.2 billion in the first half of 2021.

The update reassured investors worried about the cost of acquiring Refinitiv (which used to be Thomson Reuters’ data site). The (now completely separate) news agency Reuters explains:

With the takeover of Refinitiv, the 300-year-old exchange is trying to develop into a one-stop shop for data, trading and analytics. However, the cost of acquiring the data provider has worried some investors, and its stocks have lost 20% since early March when it revealed more details about the integration.

The group announced Friday that it has realized £ 77 million in cost synergies from the acquisition of Refinitiv on a run-rate basis. It is expected to hit £ 125 million by the end of the year, up from its previous forecast of £ 88 million.

And there was some good news for patient traders (and, uh, market reporters): London Stock Exchange Chairman David Schwimmer said the company had identified an issue causing repeated outages in its Eikon data and trading terminal.

9.17 a.m. BST

09:17

“This is still a very buoyant market by any conventional measure,” said Jonathan Hopper, CEO of Garrington Property Finders – but there are some signs that buyers are looking a little closer.

He said:

Smart buyers have started asking much more difficult questions about price. After six months, in which it was almost entirely at your own discretion, with prices rising almost from week to week, the sellers are finally forced to do a reality check.

At the forefront, we see buyers taking a more pragmatic view of pricing, and a growing number of sellers need to curb their pricing claims.

Could there be a correction next year (jargon for a 10% drop from a high)? Guy Harrington, Chief Executive of Glenhawk, a residential real estate lender, said it could be:

Despite flickering and frankly welcome signs that the fuel that is igniting the market may be running low, house prices continue to show a complete disengagement from economic realities.

Only when the picture of the pandemic fallouts becomes clear, the state incentives have been completely withdrawn and people are returning to the offices en masse, will the interpretation of the housing market make sense. 2022 still looks more like some sort of correction than not.

9.08 a.m. BST

09:08

Let’s analyze this morning’s Halifax housing data. It found that UK house prices are still rising rapidly, but the pace of growth appears to be slowing.

Jan Crosby, UK Head of Infrastructure, Building and Construction KPMG, an accounting firm, said:

While the market is buoyant, overall annual growth is slowing and we are seeing much higher demand than supply agents.

On the other hand, a higher demand than the supply usually means one thing: the price rises! That could mean that the average sales prices stay the same even if the sales volume declines a bit.

Martin Beck, senior economic advisor to EY Item Club, an accountant-backed forecaster, argued that the Halifax data provides good reason to believe that house prices will remain elevated. He said:

The July price increase in the Halifax index contrasted with a decrease in the Nationwide index. It does, however, offer some preliminary evidence that the June 30 stamp tax hike did not have too much of an impact on the property market and that other factors continued to support property prices. These include government support for household incomes and extremely low mortgage rates. While the former, particularly the vacation program, will expire in the fall, there seems little prospect of rate hikes well into next year, even after the MPC meeting in August took a more restrictive tone.

The pandemic also has potentially long-lasting effects on property preferences, including a “space race” as people look for bigger homes in a world with more homeworking. With the substantial savings households accumulated during the lockdown, there is ample fuel for real estate deposits. Meanwhile, job and income losses during the pandemic have disproportionately struck younger, lower-paid people who are generally not in the market to buy a property.

8.36 a.m. BST

08:36

Gas prices will rise after Ofgem raises its cap. Photo: Lauren Hurley / PA

Millions of households will be forced to pay some of the highest energy bills in the last decade after the industry regulator gave the green light to suppliers to raise their prices by up to £ 153 a year.

Households across the UK using gas and electricity on a standard energy tariff can expect their bills to spike sharply from October this year after the regulator lifted their winter energy price cap.

Ofgem said gas prices in Europe “rose to record highs due to a recovery in global demand and tighter supplies”, which is driving up heating bills for homes and electricity prices.

You can read the full report here:

8.32 a.m. BST

08:32

Surprising decline in German industrial production

A robot adjusts a windshield fully automatically on a model of the A-Class production line of the German automobile manufacturer Mercedes Benz in the Daimler plant in Rastatt. Photo: Kai Pfaffenbach / Reuters

Production by Germany’s powerful manufacturers declined in June, likely in part due to the global shortage of computer chips, according to official figures, surprising economists.

Economists polled by Reuters had expected production to increase by 0.5% in June, but instead decreased by 1.3%, said the Federal Statistical Office.

The decrease was due to a decrease in the production of capital goods such as machinery and vehicles, which decreased by 2.9%. Consumer goods production continued to grow and rose by 3.4%.

The shortage of semiconductor computer chips has slowed the auto industry around the world after the pandemic … well, everything. Auto companies cut their chip orders at the start of the pandemic but didn’t expect a sharp recovery in demand, while soaring home computing drove increased demand for semiconductors from consumer electronics companies.

Andrew Kenningham, Chief Economist for Europe Capital economy, a consulting firm, said there were “serious problems” with German manufacturing. He said:

Automobile production was 29% below its pre-pandemic level, reflecting the impact of component shortages, particularly semiconductors. These are likely to continue into the second half of the year and put a brake on an otherwise strong economic recovery.

Media reports suggest that automakers themselves believe the component shortage is likely to persist into next year, although they expect (or hope) the issues will be less severe. A full recovery for Germany is still a long way off.

8.11 a.m. BST

08:11

It looks very much like a Friday in August on the European stock markets. The FTSE 100 saw a slight drop of eight points, or 0.1%, to 7,111 points in early trades.

Here are the opening snapshots from major European markets:

- FRANCE’S CAC 40 DOWN 0.1%

- Spain’s Capricorn apartment

- EURO STOXX 600 INDEX REDUCED BY 0.1%; BLUE CHIPS IN THE EURO ZONE ARE REJECTED 0.1%

- GERMANY’S DAX UP 0.2%

Updated at 8:44 a.m. BST

8.02 a.m. BST

08:02

UK house price growth slows to 7.6% annually – Halifax

Good morning and welcome to our live coverage of the economy, economy and financial markets.

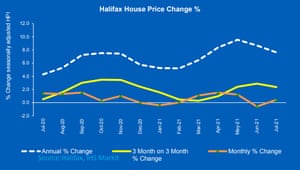

UK house prices rose 7.6% in the year through July, but Halifax, the lender who released the data, suggests this could be a sign of a “cooling market” after months of inflated activity.

The average UK home sold for £ 261,221 in July – still a cool £ 18,500 more than a year ago. Annual house price inflation, however, has returned from 8.7% in a “frenzied” June and 9.6% in May – see Halifax’s impressive blue chart for signs of a potential growth peak.

Halifax data suggested that house price growth could be on a downward path. Photo: Halifax

Of course, the 7.6% annual growth is still noticeable – and it far outperforms average wage growth at any point in the last decade (with the possible exception in May due to comparison with wage declines during the first UK lockdowns).

The reasons for the rising real estate prices (in the midst of a pandemic that paralyzed large parts of the economy for months) are now known: a combination of historically low borrowing costs, the need to catch up after the temporary market freeze, the desire for more space through lockdowns and a substantial amount of government subsidies.

The “slowdown” Halifax anticipates over the next few months is in part caused by the latter: The 0% stamp tax rate now only applies to the first £ 250,000 of the purchase price (instead of the £ 500,000 pandemic threshold). and it will reset back to standard prices starting at £ 125,000 from October.

Russell galley, CEO at Halifaxsaid:

The past few months have been characterized by historically high buyer activity, with June being the month with the highest turnover for mortgage deals since 2008. This was fueled by both the “space race” and the limited stamp duty break. With the latter now entering the final phase, buyer activity should continue to decline in the coming months and the market could face a quieter phase.

Latest industry figures show sales instructions are dropping and real estate agents are seeing a drop in their available inventory. This general lack of supply should support prices in the short term, as should exceptionally low borrowing costs and persistently strong customer demand.

The agenda

- 1:30 p.m. BST: U.S. Non-Farm Payrolls (July)

Updated at 8:04 a.m. BST