6 Causes Why Banks Want Social Media Monitoring

In in the present day’s financial market, it’s extra necessary than ever to stop issues earlier than they develop right into a full-blown disaster. However how do you keep knowledgeable when there’s a lot occurring? Get began with social media monitoring for banks – the easiest way for monetary establishments to watch on-line sentiment and keep forward of the curve.

On this article, we discover how banks can use social media monitoring instruments to guard their popularity, interact with their viewers, and enhance their social media technique.

Bonus: Obtain a free information to learn the way you should use social media monitoring to extend gross sales and conversions in the present day. No tips or boring suggestions – simply easy, easy-to-follow directions that basically work.

Social media monitoring lets you observe hashtags, key phrases, and mentions which can be related to your model. This can be a nice strategy to sustain together with your viewers and your trade.

For banks and different monetary providers companies, social media monitoring is a useful strategy to perceive your buyer base. You can hearken to your viewers, handle points earlier than an upswing happens, and develop new merchandise and campaigns that cater to their wants.

1. Defend your popularity

We all know social media is a good way to attach together with your viewers – however it’s a dialog, not a monologue.

This one-way avenue means it is completely essential to hearken to what your viewers is saying, particularly after they’re sad.

An excellent social media monitoring device may help you higher perceive how persons are speaking about your model on-line. By monitoring social media, you possibly can act on crucial messages earlier than your popularity is compromised.

Howdy! We’re deeply sorry that you’ve got had such an expertise as we are not looking for our prospects to really feel our providers on this manner. Please ship us a DM, we respect the chance to escalate this case for you. Thanks very a lot! ^ML https://t.co/jAczEAxsKu

— BMO (@BMO) June 14, 2023

If you wish to know the general tone of all conversations that point out what you are promoting, you should use social sentiment evaluation to seize buyer feelings and opinions. This may help you anticipate potential issues and take steps to repair them earlier than they develop into a PR nightmare.

The data you acquire from social media monitoring may also allow you to uncover what’s necessary to your prospects. You need to use this information to craft related information and keep abreast of traits.

2. Enhance buyer assist

As name middle wait instances proceed to extend, many purchasers are turning to social media to get faster solutions to easy questions.

Social channels usually cowl every little thing from easy sure/no inquiries to advanced subjects. Some banks provide assist by way of Instagram DM. Others ahead these requests to Twitter or their web sites.

Howdy Kelly, Thanks for reaching out to TD! We welcome your query and are blissful to give you directions on how to enroll in EasyWeb. In case you can ship us a DM we are able to talk about this additional with you. ^BH

— TD (Canada) (@TD_Canada) Could 29, 2023

With social media monitoring, you could find out which platforms your prospects favor after which create a assist technique tailor-made to that platform.

Simply be sure you meet expectations by disclosing the hours that the account can be monitored.

3. Regulate your rivals

A social media monitoring device like Streams from Hootsuite is a good way to realize insights into your competitors.

You possibly can monitor accounts, hashtags, and trending phrases to see what’s occurring on one other financial institution’s assist account, test how persons are reacting to their ongoing campaigns, and extra.

These insights additionally make it simpler to comply with trade traits and establish gaps that your financial institution could possibly fill.

4. Join together with your viewers

Social media monitoring may help you get rid of customer support points, however it additionally makes it simpler to construct and strengthen relationships with potential and current prospects.

A method to do that is to develop into a useful resource to your viewers. Use your social channels to share helpful or well timed data, e.g. B. Suggestions for opening a financial savings account or reminders for tax returns.

Over time, your followers will come to see you as a trusted useful resource. Constructing this belief is especially necessary for banks, whose prospects should belief them with their cash.

5. Discover new companions

Sponsorship is an important a part of any financial institution’s public relations technique, and main banks have a alternative of main occasions to sponsor all year long.

RBC, for instance, has introduced the Canadian Open since 2008. The US Open is sponsored by three monetary establishments (American Specific, Chase Financial institution and JP Morgan).

However what about smaller sponsorships that appear nearer to house?

Be careful for Bob the Builder!😁 https://t.co/ce98DeI8a2

— US Financial institution (@usbank) November 17, 2022

With social media monitoring, you could find out what issues most to your group and make a distinction domestically.

6. Monitor marketing campaign compliance and efficiency

Banking is a extremely regulated trade. Along with creating content material, you should be sure that it complies with all state or native laws and social media legal guidelines.

These embrace privateness, promoting, content material moderation, mental property rights and disclosure necessities.

An excellent social media monitoring device (like *ahem* Hootsuite) makes it straightforward to remain up to the mark and hold everybody on the workforce on the identical web page. With these instruments, you possibly can rapidly test the efficiency of your social media channels and observe your ongoing campaigns.

Hootsuite is compliant with trade laws, together with FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, and MiFID II necessities, so you possibly can centralize your compliance oversight.

1. Hootsuite

With Hootsuite, you possibly can handle and monitor all of your social media platforms in a single place. Banks utilizing Hootsuite for social media monitoring have entry to many highly effective instruments, together with:

analytics

Hootsuite’s social media analytics device makes it straightforward to trace the efficiency of all of your social channels in a single place. Monitor metrics like attain, engagement price, impressions and extra. Create experiences to share together with your colleagues or different departments.

streaming

Your financial institution must hold tabs on the competitors, have related conversations on-line, and shield your popularity.

With Streams, you possibly can create customized feeds to show social media posts related to what you are promoting. You can too filter posts by account, key phrase, hashtags, and even location.

inbox

By no means miss a DM once more! Hootsuite’s highly effective social inbox permits you to measure buyer satisfaction and regulate viewers sentiment.

This useful device places all of your social media messages in a single place, permitting you to bridge the hole between social media engagement and customer support.

Insights powered by Brandwatch

With Hootsuite Insights, you possibly can hear what prospects are saying, feeling, and considering to rapidly create your social sentiment evaluation. From there, you possibly can create efficient methods to develop your model, improve gross sales, and beat the competitors.

E-book a free Hootsuite demo in the present day

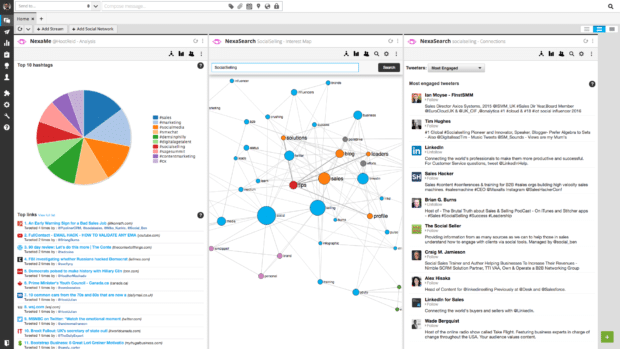

2. nexalogy

Nexalogy provides best-in-class information visualizations that may take your social monitoring to the subsequent degree.

Apart from monitoring standard key phrases and most lively accounts, the device contains superior extras like interactive timelines, geolocation-based heatmaps, and lexical cluster maps.

3. Mentionlytics

Mentionlytics is an expert social media monitoring app that tracks mentions, key phrases and sentiment in a number of languages.

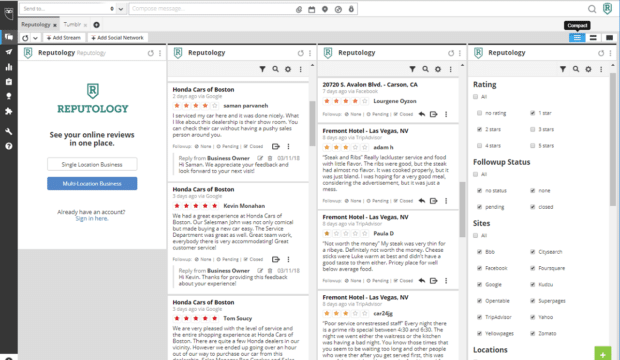

4. reputationology

For customer-facing companies, a foul assessment may be devastating if it isn’t addressed rapidly. With Reputology, you possibly can monitor key assessment websites like Yelp, Google, and Fb opinions from one dashboard.

You possibly can observe exercise throughout a number of storefronts and places, and reply by way of fast hyperlinks.

5. Talkwalker

Talkwalker provides 50+ filters to watch conversations throughout 150 million information sources together with blogs, boards, movies, information websites, assessment websites, and social networks.

You possibly can simply analyze engagement, attain, feedback and model sentiment.

bonus: Watch our AMA with Talkwalker right here to study extra.

How is social media used within the banking trade?

Banks use social media to succeed in their audience and market their merchandise. Many banks additionally use social media to supply direct message customer support.

Why ought to a financial institution use social media monitoring?

By monitoring social media, banks can acquire a greater understanding of their buyer base, see how their present choices are performing, and keep forward of traits when creating new merchandise and campaigns.

What may be monitored on social media?

Banks can use social media to watch every little thing associated to their model and trade. This contains hashtags, key phrases, mentions, information articles, and on-line conversations.

What laws apply to using social media by banks?

Banking is a extremely regulated trade. Social media posts and interactions should adjust to federal and native legal guidelines. Regulators overlaying banks’ use of social media embrace FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF and MiFID II.

What ought to banks contemplate when utilizing social media?

Every social media platform has its personal authorized necessities. Banks should guarantee they adjust to privateness, promoting, content material moderation, mental property rights and disclosure necessities for every platform they’ve a presence on.

Hootsuite makes it straightforward for banks and monetary providers suppliers to watch social media. Handle all of your networks, develop income, present customer support, mitigate threat, and keep compliant—all from a single dashboard. Learn the way Hootsuite can work for what you are promoting.

Watch a demo

Get extra leads, interact prospects, and keep compliant with Hootsuite, the The main social media device for monetary providers.