Taboola: Navigating An Evolving Digital Advertising Panorama (NASDAQ:TBLA)

Joshua Sammer/Getty Images Entertainment

Taboola.com Ltd. (TBLA) has been on a long downward slide ever since its IPO in June 2021. A combination of unstable earnings and other issues forced the stock down to 52-week lows of below $6.00, wiping out more than 45% of the company’s market cap . Leading up to the Q4-21 and FY-21 earnings announcement a few days ago, the stock appeared to rally hard to breach and go beyond $7.30 but the momentum wore off even as Taboola missed its normalized earnings consensus estimate of $0.16, coming in at only $0.09 for the quarter.

Seeking Alpha

Hard-hit stocks sometimes offer hidden upside potential that the market doesn’t read and therefore doesn’t price in, but the investment decision can be challenging because you’re essentially taking on a contrarian approach, which is not natural for most investors.

Although such a stance has been espoused by many an investment guru, the average investor is unlikely to make an investment decision that goes against the market’s sensibilities. But that’s exactly what’s required when you come across a case like Taboola’s. The market is clearly failing to give the stock any sort of bottom (or so it would seem), but there’s clearly some sporadic enthusiasm that allows for short rallies, even if it’s not setting new highs in the process. The latest price action in February leading up to the earnings call clearly shows this.

Investment Thesis: There’s a significant amount of long-term value in TBLA at the current as-of-writing price of $6.65. The Connexity acquisition last year, recent deals inked with Microsoft (MSFT), Samsung (OTC:SSNLF) Brazil, Xiaomi (OTCPK:XIACF), and other publishers, and a business model built on contextual advertising are all drivers of Taboola’s long-term prospects.

Revenue Strength

The strength of revenue growth tells us a lot about how the company is addressing a particular demand within a niche segment – in this case, digital advertising. This is a $350 billion market (2020) expected to bloat to +$785 billion through 2026, growing at a CAGR of nearly 14%. Taboola’s own quarterly YoY revenue growth performance over the past few quarters has almost consistently been above that range – in the 16% to 22% band, give or take.

Taboola Q4-21 Earnings Presentation

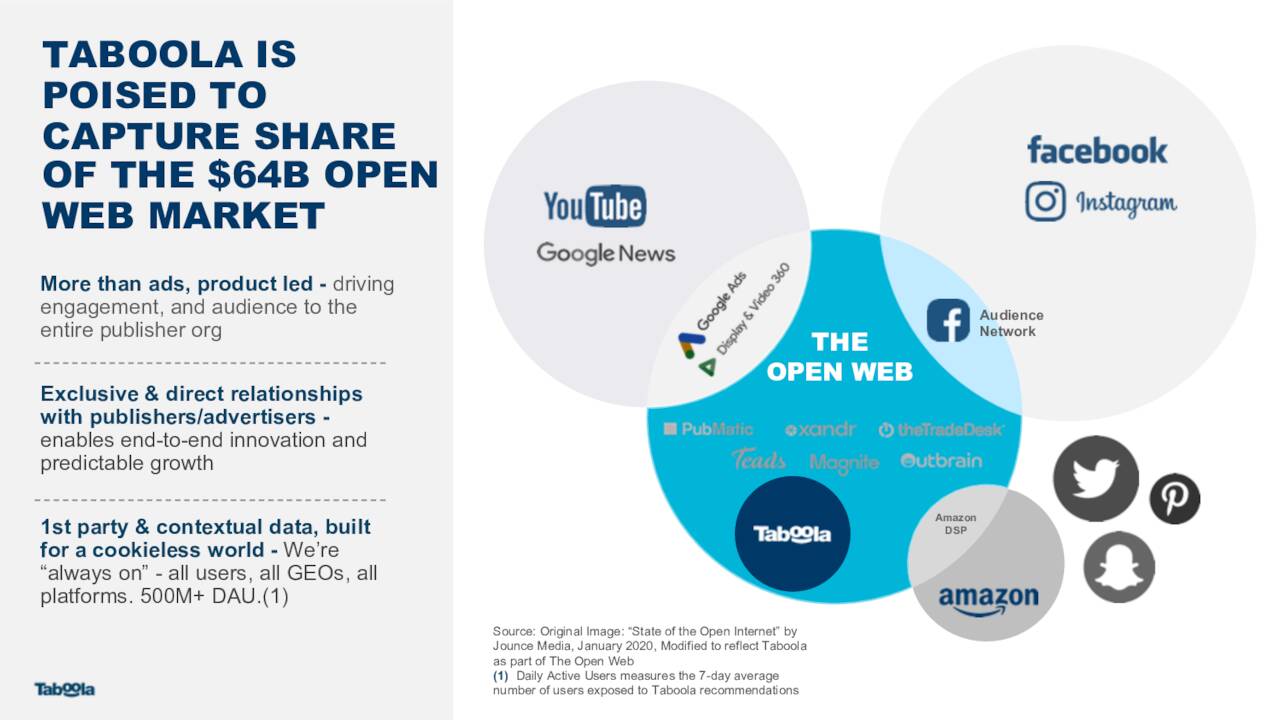

Even if you only take the direct TAM (total addressable market) of $64 billion cited by Taboola, that figure has nearly doubled after the acquisition of Connexity, which brings in another $60 billion in terms of market potential for a combined TAM of $124 billion.

This growth has been on the back of numerous long-term partnerships with publishers around the world. Taboola typically hunts for multi-year deals that are periodically reviewed for upsell opportunities, as in the case of its renewed agreement with Future that brings in mid-article ad placements.

The real revenue-generating power comes from the types of ads that Taboola serves. They are categorized as ‘contextual’ ads as opposed to ‘behavioral’ ads that track the user’s online habits to learn their preferences. I think it’s important that investors understand this core difference because, in a world rapidly moving toward privacy and the use of visitor data, Taboola has a lead over most large advertising companies in that regard.

Contextual vs Behavioral Digital Advertising

A behavioral approach to serving ads involves creating hypothetical user personas based on actual browsing behavior. For instance, if you’ve ever shopped for a pair of sneakers and browsed through a few websites for it, you’ll notice that you’re suddenly inundated with sneaker ads wherever you go on the web after that. The ads you see, therefore, are based on your past searches and are sometimes referred to as remarketing. But this type of advertising is often considered intrusive because it relies on actual user data to work – even if that data is somehow ‘anonymized.’

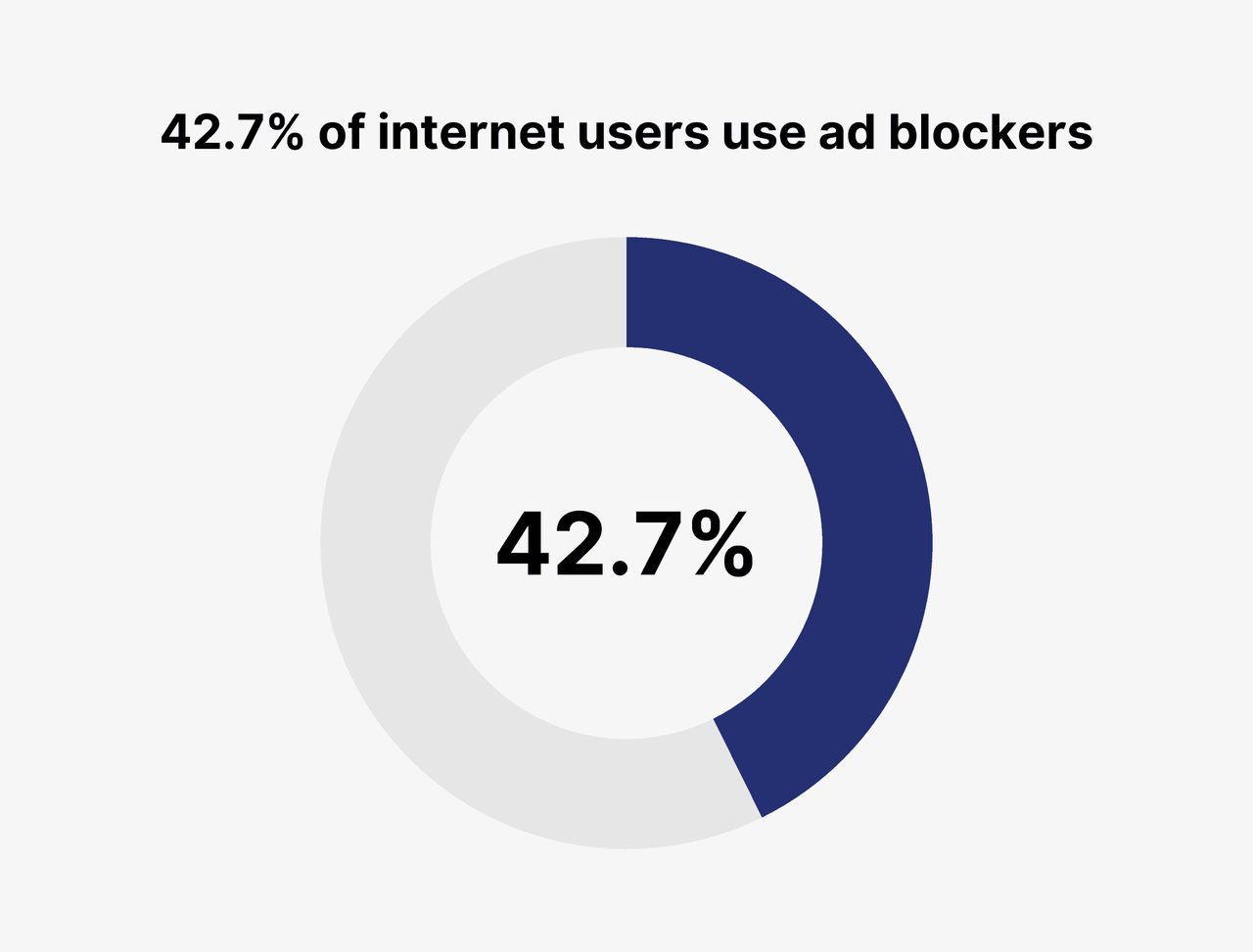

There are essentially two problems with behavioral digital advertising: the first is the intrusive aspect, which is already running afoul of regulatory mandates such as the GDPR in the EU; the second is ad blockers, which are now used by nearly 43% of the world’s Internet users.

backlinko

Pressure has been mounting on ad-tech giants such as Alphabet’s Google (GOOG) (GOOGL), who are actively in the process of transitioning away from behavioral or targeted advertising on the back of regulatory attacks on their revenue base. Targeted ads require the use of cookies or small text files on websites to track your presence and behavior. For the past several months, Google has been testing out something called Topics, a form of contextual targeting that differs from keyword targeting, another contextual ad-serving method. Topics-based ads are served based on the broad topics that are covered by the web page that the user visits.

This transition to contextual advertising is an important shift because most browsers will implement the blocking of third-party tracking cookies by 2023. Google originally planned this for 2022 but has delayed implementation until the end of next year.

As we move to a more privacy-aware Internet and the use of ad blockers continues to rise, companies must move quickly to contextual advertising.

Contextual advertising relies on the context of web pages rather than search behavior. Using a combination of factors, the ad platform will serve ads that match the content that the user is currently viewing rather than using historical browsing data.

And that’s where Taboola already has a significant lead over the competition, even major players such as Google and Meta (FB). Its contextual platform serves ads based on the page that the ad is being displayed on, not the user’s past behavior. As such, it sidesteps a lot of regulatory landmines. It also makes it harder for ad blockers to eliminate Taboola’s recommended or sponsored content from the browsing experience because these are considered to be “native ads.”

Of course, Taboola also relies on third-party website cookies to serve relevant ads, which it calls “Interest-Based Advertising”, but it also allows users to opt-out of the service by changing their browser and device privacy settings. The important difference here is that Taboola has its own 1st-party identifier cookie, which allows the platform to personalize its ads based on deep contextual awareness of the web page in question rather than rely on third-party cookie data.

Per Founder and CEO Adam Singolda at the Q4-21 earnings call:

Taking a step back, over the past year, the Open Web has begun to transition from its addiction to tracking user data and is shifting to contextual targeting. I’m encouraged by where the industry is going. It’s safer for users and contextual advertising is the source of Taboola’s strength. Advertisers can reach users on Taboola based on their reading preferences, what makes them curious, what interests them, what they’re watched and read, not just what they told social network about themselves. This is the future of our industry, especially in the back of all the changes we’re seeing with Apple, Google, and more.

The evidence that this essential difference has created a sustainable business model for Taboola is in its past results and its outlook for FY-22. In FY-21, Taboola generated $1.38 billion in total revenues – or 16% up from the prior year. For FY-22, the company has guided for $1.67 billion for a YoY growth rate of 21%, which means revenues are on a solid growth path over the next few quarters.

Powerful eCommerce Play

Taboola’s positioning as a recommendation engine for content is now extending into the eCommerce space with the acquisition of Connexity in September 2021. In the words of Mr. Singolda:

With Taboola, e-commerce brands are no longer trapped within the walls of Amazon.

The Connexity rollout to Taboola’s publisher base in the EMEA and APAC markets has been quite successful. The past holiday season saw a significant bump in numbers as well, during which “Connexity’s publisher commissions grew over 27% year-on-year, with Earnings-Per-Click increasing 28% and order value up 24% in November.”

Globally, the eCommerce recommendation market was estimated at $2.12 billion in 2020 and is expected to exceed $15 billion by 2026 with a strong CAGR of +37%, per Mordor Intelligence.

Taboola is on the bleeding edge of this growth phenomenon, with ambitious plans to break Amazon’s vice-like grip on the eCommerce recommendation platform market. It’s not likely to get there in the next few years, but the strong partnership expansions being forged between Taboola and its publisher base with respect to the Connexity rollout is certainly a promising beginning.

Investor’s Angle

The factors that influence Taboola’s future prospects seem to be lining up nicely, which is where the long-term value will come from. If you’re willing to stay the course and hold on to TBLA for several years, it’s likely that you’ll reap handsome rewards as the story plays out.

Much of the perceived risk from the changing landscape of digital marketing is already priced into the stock, which is where a lot of the downward pressure has been coming from. But, as we saw, Taboola has laid plans for a cookie-free future and an environment of stringent regulatory checks and measures, which essentially negates this particular risk.

As for the profitability question, adjusted EBITDA to ex-TAC (total acquisition cost) gross profit is currently at around 35% for FY-21; the guidance for FY-22 is around 31% at the midpoint, which would seem to represent a growth slowdown but is necessitated by the need to attract more publishers to the combined Taboola-Connexity platform for content and product recommendations.

To summarize, Taboola has a long and strong growth trajectory ahead, primarily powered by its inherent strength in the contextual digital advertising market and, more recently, through the synergies with connexity that have further lengthened the growth runway.

At the current as-of-writing price of $6.65, TBLA is a steal, but only if you’re willing to stay in for the long haul. The adjusted forward earnings multiple of 13.5 puts TBLA at a discount of around 24% against the sector median of 17.7. Street analyst price target averages for TBLA are in the range of $11.00 to $11.43, representing an upside potential in the range of 65% to 72%, and that’s just the 12-month PT. Long-term, I believe this company shows much greater potential as a tech-savvy innovator moving fast and in the same direction as the evolving market.

Despite the recent earnings miss for Q4-21, the stock has estimated +11% over the past few days, indicating that it could have found some steam on the back of investor confidence returning to the stock. This might be the right time to get in on a long-term growth story that will likely last for decades to come.