Pandora Papers: Corinna Larsen and businessman Allen Sanginés-Krause co-owned an organization in Seychelles | USA

Allen Sanginés-Krause and Corinna Larsen. Illustration: Sr. García

Corinna Larsen, the German businesswoman who once had a love affair with Spain’s retired King Juan Carlos I, was once a co-owner of a company in a tax haven with the Mexican entrepreneur Allen Sanginés-Krause. The prosecutor of the Spanish Supreme Court is investigating the latter for payments to Juan Carlos that have not been reported to the Spanish tax authorities.

The evidence exposing this previously unknown link between Larsen and Sanginés-Krause can be found in the Pandora Papers, a massive leak of 11.9 documents from 14 offshore service providers. The investigation was coordinated by the International Consortium of Investigative Journalists (ICIJ) and counted on the participation of EL PAÍS and the Spanish television channel La Sexta. The leak covers five decades of documentation and enables the reconstruction of operations carried out by politicians, multimillionaires, criminals and elite athletes in countries and territories, due to their confidential handling of the exchange of tax information and the low tax rates on foreign capital.

More information

The company in question was called Fortuna Ventures Ltd. and was registered in the Seychelles on October 1, 2009. Larsen used her company, Apollonio Holdings, to start the company, while Sanginés-Krause used Montpascal Holdings, a company with which he was affiliated. Documents held by EL PAÍS indicate that these two companies are shareholders of Fortuna Ventures Ltd. and that Larsen was the director. Neither of them responded to requests from the consortium about the revelations.

Until yesterday, the Seychelles were considered one of the most widely used tax havens by fraudsters around the world. But the European Union removed them from their blacklist on Tuesday. Foreign companies registered in the Indian Ocean archipelago are exempt from paying taxes and do not need to provide a minimum capital to register a company. According to a law on international trade that has been in force since 1994, there is also no obligation to publicly register the names of managing directors.

Larsen has worked for many years as a consultant and fixer in international companies through another of her companies, Apollonia Associates, based in the microstate of Monaco on the French Riviera. A Swiss public prosecutor, Yves Bertossa, is investigating Larsen for an alleged money laundering offense for having received € 64.8 million in a bank account from her in the Bahamas that was transferred from a Swiss account owned by Juan Carlos I.

In an interview with the prosecutor in 2018 and as announced by EL PAÍS, she quoted the name of Apollonia Associates. She also confirmed that she began her advisory work for Apollonia Associates in 2004 with jobs for Richemond and Volkswagen “unrelated to Juan Carlos I.”

Your company Apollonia Holdings GMBH was not yet known. The company was founded by Panamanian law firm Alemán, Cordero, Galindo & Lee (Alcogal), which, according to Pandora Papers’ investigation, has created a steady stream of opaque structures and mailbox companies to hide wealth from the world.

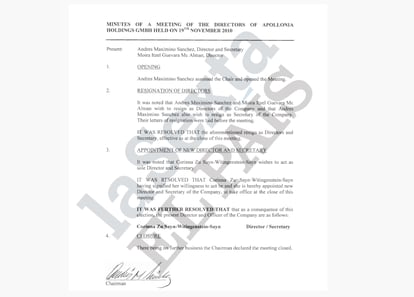

On November 19, 2010, Larsen was appointed director and secretary of Apollonia Holdings GMBH, a mailbox company, replacing Andrés Maximino Sánchez.

A document from Apollonia Holdings. THE COUNTRY / La Sexta / ICIJ

A document from Apollonia Holdings. THE COUNTRY / La Sexta / ICIJ A certificate of incorporation for Fortuna Ventures. THE COUNTRY / Friday / ICIJ

A certificate of incorporation for Fortuna Ventures. THE COUNTRY / Friday / ICIJ

On June 2, 2010, the Apollonia Holdings GMBH Montpascal Advisory Services, Sanginés’ company, issued an invoice for € 30,000 without specifying the purpose. The invoice was sent to the address of Montpascal Advisory Services at Killua Castle, an imposing castle near Clonmellon, Ireland. This property was visited by the retired king.

The prosecutor of the Spanish Supreme Court has opened three investigations against the retired king. One of them is based on a report by the Spanish financial services division Sepblac, which warned that Mexican businessman Allen Sanginés-Krause made three bank transfers to Nicolás Murga Mendoza, a former Air Force Colonel and assistant to Juan Carlos I, between 2017 and 2018 Some of these payments were transferred to the accounts of members of the Spanish royal family and others in their circle who had access to these amounts via credit cards.

Prosecutors have received a testimony from the 61-year-old Mexican businessman and Murga Mendoza. Sanginés claimed they were “donations” to the retired king, given their friendship.

Juan Carlos I made a voluntary regularization with the Spanish tax authorities in the amount of € 678,393, as the money received from Sanginés-Krause had not been declared. As announced on Wednesday, the public prosecutor plans to close all three cases against the retired king, who are under investigation.

During the years of the relationship between Larsen and the then king, both of them regularly spent time with Sanginés-Krause, at parties and other private celebrations, but the business connections between him and the German consultant were not yet publicly known.

Big purchases

Sanginés-Krause, founder of the investment group BK Partners and former senior executive of the US bank Goldman Sachs, is little known in his home country of Mexico, despite major acquisitions in the real estate sector such as the Four Seasons Hotel. He acquired the luxury hotel complex Mayakoba in Cancun and the Hotel Villa Magna in Madrid, where he usually stays when visiting the Spanish capital.

The Pandora Papers also revealed that in 2007 Larsen planned for the managers of a trust called Peregrine in New Zealand to make arrangements so that if they died, 30% of the proceeds of what is known as the Spanish Saudi mutual fund, Juan Carlos I, would be bequeathed. The fund was supported by the then king and she had worked for it. The unsigned documents were created on March 27, 2007, 14 days prior to the registration of the Spanish Saudi Investment Fund in Guernsey, another tax haven. Larsen’s attorney has stated that these documents are false.

English version by Simon Hunter.