Chip scarcity: Fleet and enterprise firm automobile registrations decline

Semiconductor shortages are blamed for poor fleet and business vehicle registrations, with the company car market dropping 43.4% year over year, new figures suggest.

Last month, according to new data from the Society of Motor Manufacturers and Traders (SMMT), 94,752 new cars were registered for fleets and businesses, compared to 166,679 units registered in September 2020.

Since the beginning of the year, however, new company car sales are almost 7% above the level of the previous year, with 691,743 fleet and commercial registrations compared to 647,944 in the first nine months of 2020.

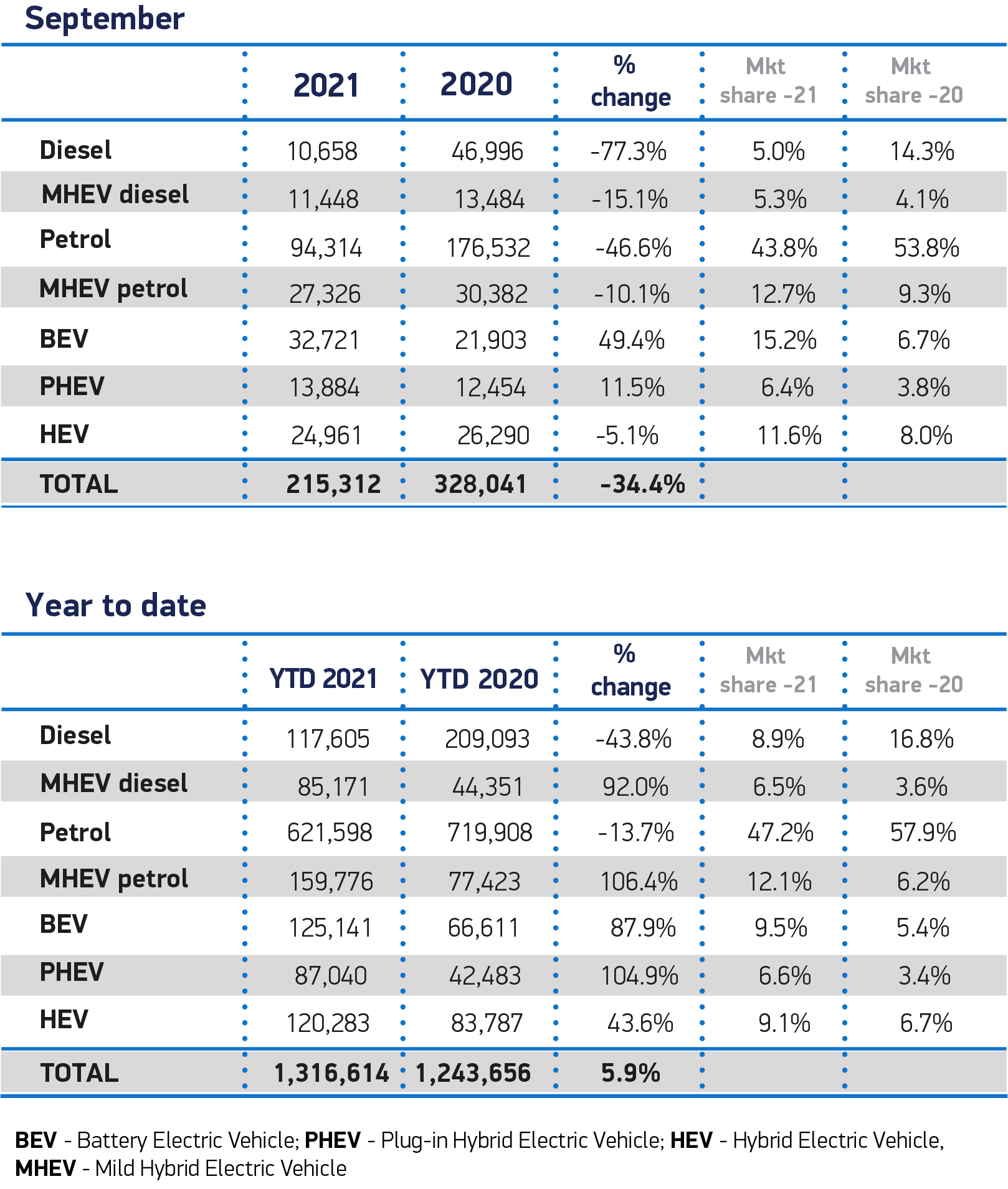

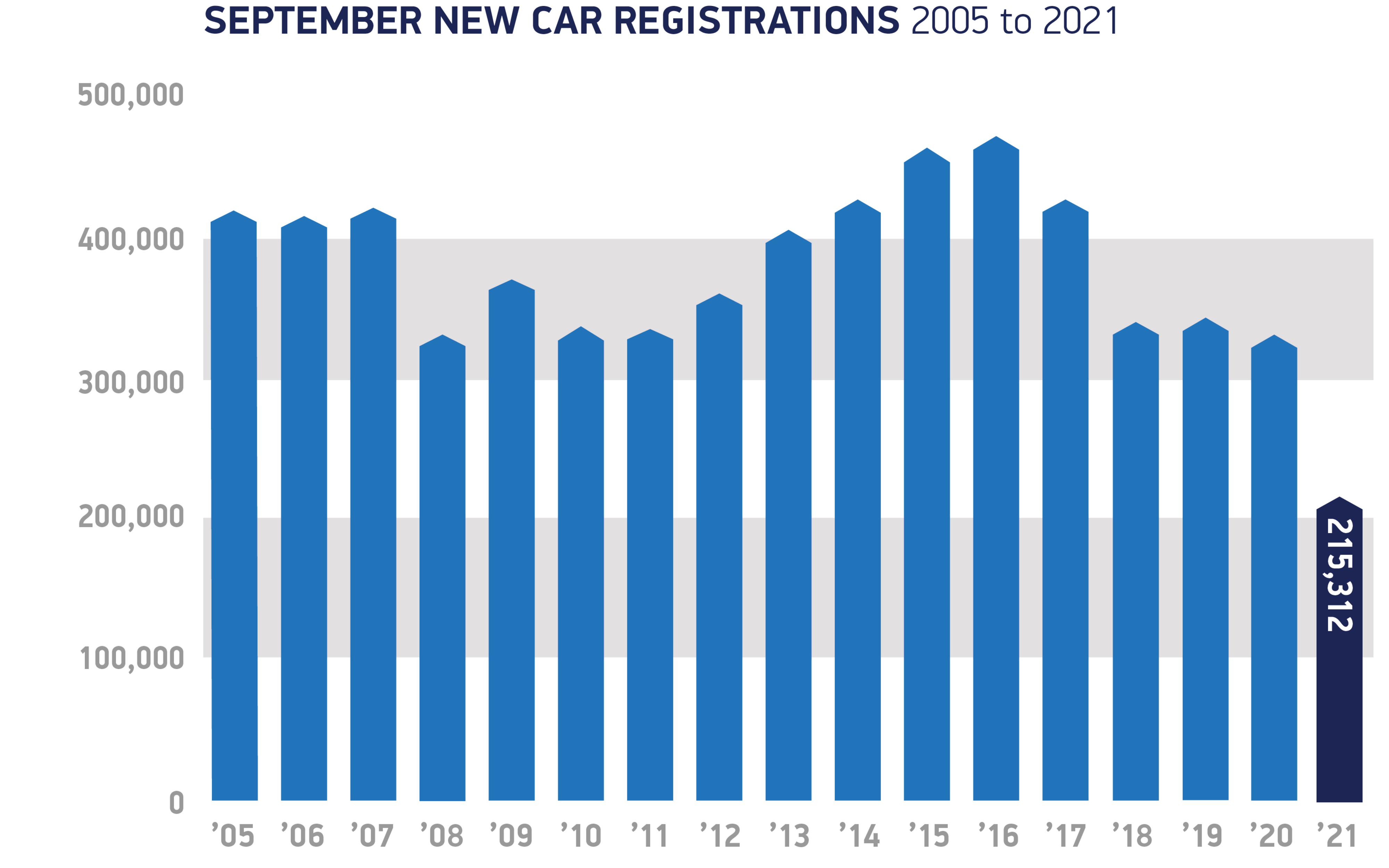

The fleet and company accounted for 44% of total new vehicle sales during the month. A total of 215,312 new vehicles were registered in September, around 34% fewer than in September 2020.

It was the weakest UK new car market in September since 1998, prior to the introduction of the two-plate system in 1999.

September is usually the second busiest month of the year for the industry, but as the ongoing shortage of semiconductors affects vehicle availability, performance in 2021 was also 44.7% below the 10-year pre-pandemic average, such as SMMT- Guess numbers.

SMMT CEO Mike Hawes said: “This is an extremely disappointing September and further evidence of the continuing impact of the Covid pandemic on the sector.

“Despite the strong demand for new vehicles in the summer, three months in a row were affected by delivery bottlenecks due to lower semiconductor availability, especially from Asia.”

Admission of new electric vehicles

September was the best month so far for the introduction of new battery electric vehicles (BEV). With a market share of 15.2%, 32,721 BEVs were registered in the month.

In fact, the launch in September was only around 5,000 vehicles below the total registered throughout 2019.

The plug-in hybrid share (PHEV) also rose to 6.4%, which means that more than every fifth new vehicle registered in September was emission-free.

Meanwhile, hybrid electric vehicles (HEVs) grew their total market share from 8% in 2020 to 11.6%, with 24,961 registered per month.

Hawes said that despite the supply challenges, the “frenzied adoption” of plug-in vehicles, especially battery electric cars, shows the increasing demand for these new technologies.

Jamie Hamilton, Automotive Director and Head of Electric Vehicles at Deloitte, said, “With battery electric vehicles even overtaking plug-in hybrids this month, it shows consumer confidence that the charging infrastructure will be in place.

“However, there are still gaps and a fairer introduction of public charging points would ensure that electric vehicles are also accessible to households without off-street parking.

“The shortage of gasoline and diesel could also have inadvertently led to a certain amount of fear when charging.

Meryem Brassington, Lex Autolease Director of Electrification Proposals, added, “The recent fuel shortages will only further raise awareness of the importance of moving into an electric future. As EVs become more popular, the industry must work together to ensure that there is no tipping point where demand exceeds supply. “

The effects on vehicle supply will last until 2023

Fleet operators and company car drivers face delays of more than a year on certain new cars and vans, while others are shipped with missing features as the global semiconductor shortage worsens.

And some automotive executives don’t see the problem anytime soon.

It is predicted that the disruption could last until 2023. Daimler CEO Ola Kallenius said at the Munich Motor Show last month (Sept. 7-12) that rising demand for semiconductors means the auto industry may struggle to get enough of them over the next year through 2023, though the scarcity should be less severe by then.

The automaker has lowered its annual sales forecast for its auto division and expects deliveries to be around the 2020 level and not increase significantly.

Critics predict the crisis will have a bigger impact on the automotive industry than the coronavirus pandemic. Nearly 95% of fleets that responded to a Fleet News survey said they were affected by vehicle delays.

Fleets are urged to hold on and keep ordering new vehicles, while warning that existing models may need to be on the road for more than 12 additional months.

Matthew Walters, Head of Consulting Services at LeasePlan, said, “The impact on the fleet is pretty serious.

“Over the past year, during the worst time of Covid-19, we saw a number of formal extensions for businesses where vehicles could not be delivered and picked up. These vehicles had to be extended outside of their main contract period.

“Now we are in a situation starting next year where we as an industry will likely see an expansion program again.

“I think there is a similar activity now with our customers to help them understand what it means for their current order bank when their orders will be delivered and what that means for their exchange cycles.

“The customer still has to place orders for vehicles to be in the queue, and we work with them and are open and open about when these vehicles will be delivered.”