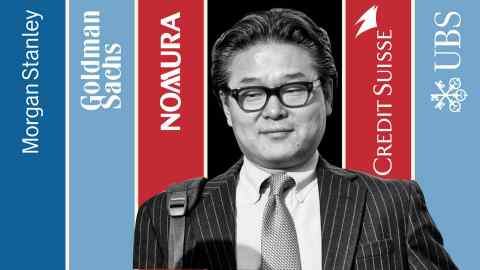

Archegos debacle reveals hidden threat of banks’ profitable swaps enterprise

The Archegos Capital debacle exposed the hidden risks of the lucrative but opaque equity derivatives business, through which banks enable hedge funds to place oversized bets on stocks and related assets.

The sour bets made by Bill Hwang’s family office have resulted in significant losses at Credit Suisse and Nomura, underscoring how these tools can spark a chain reaction that cascades across financial markets.

Archegos was able to acquire tens of billion US dollars exposure to stocks including ViacomCBS through total return swaps. This type of “synthetic” financing is popular with hedge funds as it allows them to place very large bets without buying stocks or disclosing their positions.

The lack of transparency allows companies like Archegos to enter into similar swaps with multiple lenders who are unfamiliar with the investor’s overall risk, which increases the risk for hedge funds and banks if positions backfire.

According to Finadium, a consulting firm, global synthetic equity finance banks including total return swaps generated estimated revenues of $ 11 billion in 2019, double the 2012 level.

The business, which has grown rapidly since the financial crisis, accounts for more than half of total bank equity financing revenues – more than traditional margin loans and loan stocks combined for short sales combined, according to Finadium. Synthetic financing continued to be taken over by other forms of equity financing in the first half of this year.

Banks earn steady sources of income through total return swaps through the regular fees that investors such as hedge funds pay for entering into the agreement. The investor is then paid by the bank when the stock or other related assets, including indices, increase in value. The bank also offers dividends to investors associated with holding the stock.

The bank offsets its exposure by either owning the underlying stocks, taking the opposite position with other clients who disagree, or buying protection from another financial institution.

Should stocks go down, the investor will need to make regular margin payments, usually quarterly, to make the bank complete.

“Since most swaps are executed with large notional amounts. . . This could expose the total return payer (usually a commercial or investment bank) to the risk of default by a hedge fund if the fund is not adequately capitalized, ”said Deloitte.

This is exactly the situation Archegos faced when several of its positions cratered and banks had to sell the hedges – the stocks – in a rush. The situation was made worse because Archegos entered into swap agreements with several banks.

Although the major banks have pages and pages of information on derivatives, they are usually so high that you will not get anywhere near information on exposure to individual counterparties / securities

Because equity total return swaps are bespoke or over-the-counter contracts between two parties, they are not cleared and reported through an exchange. Investors are also not required to report their synthetic equity exposure to the US Securities and Exchange Commission as they would if they had the same exposure over cash.

“We have a fundamental problem with reporting holdings of synthetic equity that is non-secret and not new,” said Tyler Gellasch, former SEC official and executive director of Healthy Markets, an advocacy group.

“If there are five different banks providing funding to a single customer, every bank may not know this and instead think that they can sell their exposure to another bank if they get into trouble – but they can’t, because these banks are already exposed. “

The growth of the equity total return swap market developed as a natural result of the Basel and Dodd-Frank rules, which are often preferred [total return agreements] on cash equity financing, ”said Josh Galper, Managing Director of Finadium, about the international and US reforms following the financial crisis.

For banks, providing synthetic equity exposure is an attractive business because consolidating client positions requires less regulatory capital than traditional margin loans.

“Capital ratios, liquidity metrics, and the ability to settle trades can make total return swaps more beneficial,” said Galper.

Recommended

Based on the information provided by the banks, it is difficult for outsiders to measure exposure to equity total return swaps.

“Although the major banks have pages and pages of information on derivatives, they are usually so high that you can’t get anywhere near exposure to individual counterparty / security exposure,” said Dave Zion of the Zion Research Group. who specializes in accounting.

“The information on concentration of credit risk tends to be at the industry level and is focused on net derivative exposures,” while the gross numbers can be more revealing when it comes to market risk, he said.

According to Nick Dunbar of Risky Finance, a consulting firm specializing in banking information, some banks treat equity total return swaps as secured loans for accounting purposes. “They are not posted at the bank’s derivatives trading desk, so they do not appear in the Basel III records” of the risk-weighted assets, leverage and credit risk that all global banks must take.

The lack of disclosure means that the equity total return swap business, which is generally a source of constant profit for banks, carries rare but serious risks. A banker at an international banking derivatives desk said that “it was very difficult to know who owned what,” and therefore equity total return swaps are “a classic case of nickel being picked up in front of a steamroller.”

“You can pick up these nickel all day. This steamroller moves pretty slowly. But if you trip, boy, you will be run over, ”he said.