5 Fast Buyer Acquisition Methods

Editor's Note: This contribution comes from a speech by Roland Frasier about the Traffic & Conversion Summit 2019.

There are 5 things you can do in your company to grow really fast.

# 1: Co-branding with product integration partnerships

Use a corporate network of customers to build your own customer base.

- Dominos works with Days Inn & Travel Lodge and places Domino cards in every hotel room

- Rolls Royce works with country clubs

- Rolls Royce doesn't pay them anything. The advantage for the Country Club is the experience they can offer their customers

- Casper and West Elm Furniture Company

- They are the mattresses on all beds since West Elm does not sell mattresses

Increase the value of your business for your customers (such as Rolls Royce) or raise an advertising fee (dominos) or have a share in sales. You can also search for companies that are already in these partnerships and make a better offer for them.

- For example, another West Elm Furniture Company mattress company could give more revenue sharing and replace Casper

# 2: Tap on the strangely powerful effect of the butterfly lever

Leverage of butterflies is about finding ways to make more money with a product or service.

How can you monetize something you are doing? Every time you do something, look for other ways to monetize.

For example, you can convert an event into multiple events and create a 7-digit ROI. T&C did this with Richard Branson.

- Hire Richard Branson to speak at T&C

- Offer a private reception with Branson for $ 15,000 / ticket

- $ 300,000 profit going to Richard Branson's Foundation (we didn't have to pay out of pocket to bring him here)

- Anyone who has received a ticket will become a War Room prospect (20 prospects added)

- Offer a private business lunch with Branson

- We offered a lunch prize with Richard Branson competitions

- I have 1,522 pixels

- Business Lunch Live Podcast episode with Branson

- Leads to 2,372 podcast subscribers

- Put us in the top 200 worldwide charts

- Sells 619 T&C tickets via Sir Richard Branson coupon code

- Sells 728 more via speaker announcements

- Every speaker at the show wanted to be identified as sharing the stage with Richard Branson

- They all emailed their list to demonstrate this

- $ 720,000 in sales

The bottom line of all of this was an additional $ 1.5 million.

# 3: Structure for "selling the eggs" and keeping the geese

This way we can sell part of our business without losing the momentum we have created in recent years. We essentially spin off our business assets and keep our platform.

Example: T & C has sold a domain name, a list of participants and a brand to Clarion Partners. We have kept the sponsoring sales company, the media company (DigitalMarketer), our mastermind (War Room) and our personnel company (no employees have participated in the sale of the company).

Our next step in the event world is partnering with Brendon Burchard to acquire half of his expert academy. Our leverage was to involve our sponsoring, media and event staff in the partnership. What did we do? Took the general terms and conditions out of the picture and replaced them with the expert academy. Next year we can do the same with another event. It is not a formula to sell our eggs, but to keep our goose.

Clarion Partners is already interested in buying this event. We have a machine that can turn on event by event to create new assets.

Structure like this so you never end up without a platform.

# 4: Scale the most effective activities, eliminate the least effective activities and verticalize them

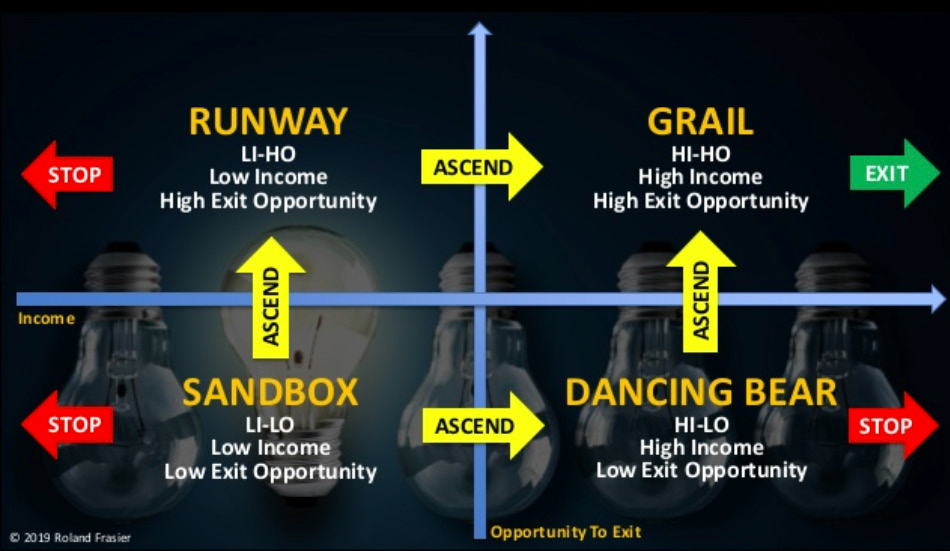

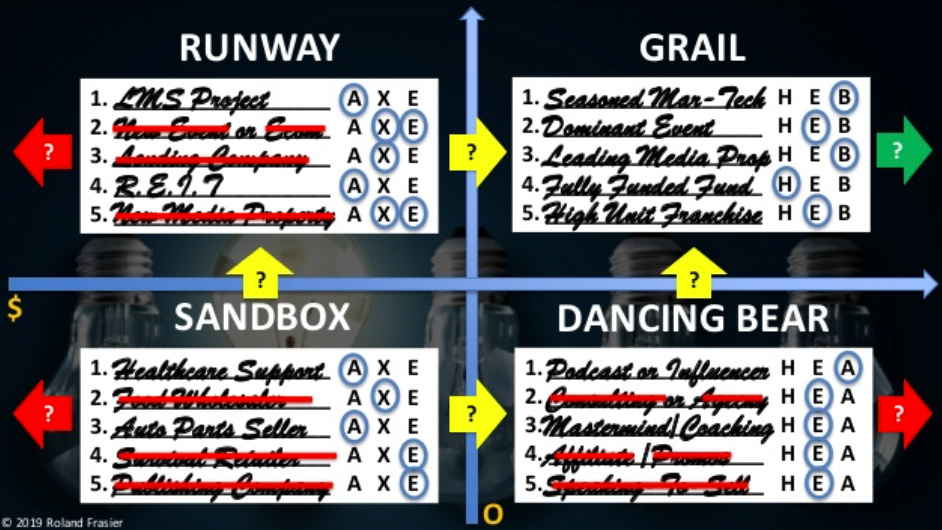

First, think about the types of companies you have. There are 4 types:

By systematizing and analyzing what you do, you can make good decisions about what you want to focus on to leverage in the future.

Questions you should ask yourself:

- What are the most effective activities you are enjoying right now?

- What least effective activities can we eliminate?

- In which additional industry can you expand your most effective activities?

# 5: Grow through acquisitions

There are 4 steps to acquire growth.

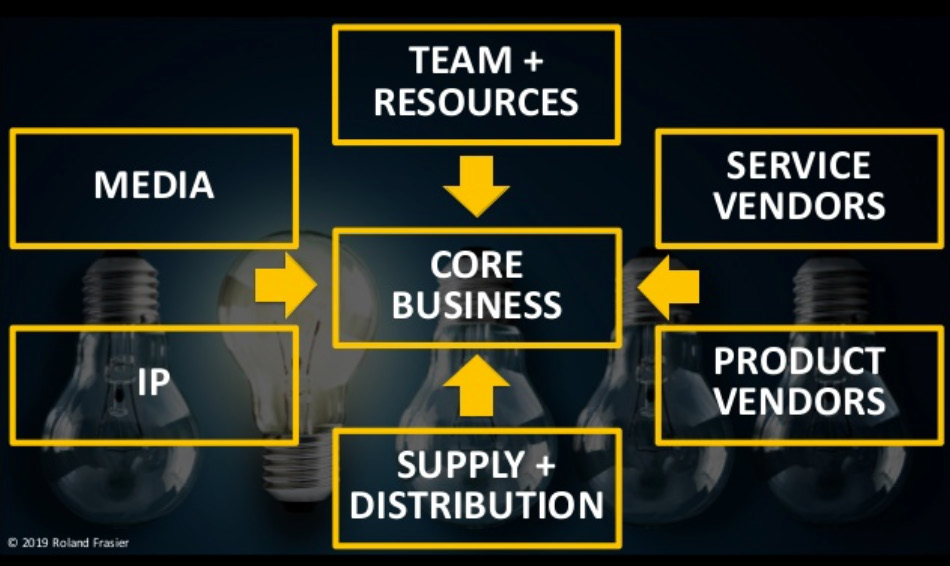

Step 1: Decide what types of companies you want to acquire.

- Acquire your competitor to drive him out of the market

- Acquire media

- Facebook group

- LinkedIn account

- YouTube account

- Purchase for a team

- Buy a company with products or services

- Consolidate the supply and distribution chain

- Acquire intellectual property (IP)

Step 2: Buy companies for nothing.

8 business buying strategies:

- Bear owner

- Buy a company for $ X if it takes back the funding and you have it repaid over time

- You can add the option to give interest

- Earn

- Based on future performance, you can get additional money for the company you sold

- If you buy the company, the risk is reduced

- Swaps

- Swap shares or assets in one company

- Asset based lending

- Buy the company, but get it amortized by existing assets

- Shared equity

- Self-liquidating payments

- The payment is what you know you can repay

- Baseline

- Offer the first $ 3 million to serve as the base, and after you've done your magic, everything is split up to 50/50. After 3 years, when the 50/50 are equal, we throw away that base

- Pipe wrench

- If you contribute more than 10% of customers to another company

- Don't build your brand for them

- Give me equity in your company

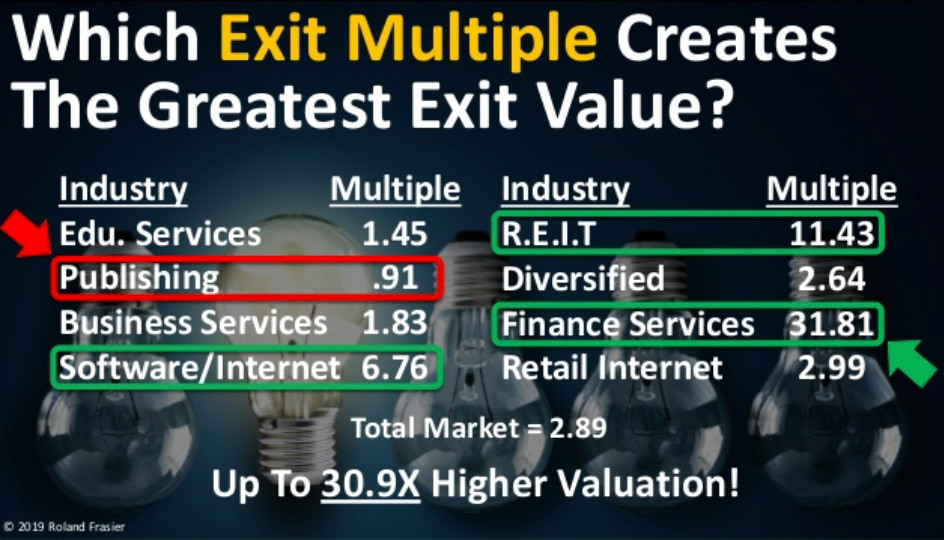

Step 3: Find the exit multiple for each profit center.

Find the multiple for your industry and turn your company to the highest possible multiple. Here is a rating chart for the V / Sales company that shows how diverse your company is:

Step 4: Positioning in the direction of the highest output multiplier.

Which exit multiple produces the largest exit value? For example 584

DigitalMarketer looks like this:

Our multiple increased from 0.91 in 2014 to 7.73 just by changing our work.