German industrial companies adapting fashions for brand spanking new regular

The willingness to change and adapt has helped German industrial companies to maintain their competitiveness through an ongoing economic crisis – according to a new report from Alvarez & Marsal.

2020 was a difficult year for industrial supply chains. The German automakers were running out of parts at one point due to lockdowns in Wuhan and Italy, while the lack of production in China led to a shortage of antibiotics at another stage.

These are some of the disruptions highlighted by Alvarez & Marsal to illustrate the extent of the upheaval in various industries. The company conducted a survey of more than 140 leading companies in the automotive, manufacturing, chemical, consumer products, and other industries to see how they were doing it.

And the results are surprisingly positive. Almost 40% of industrial companies have actually increased their competitiveness since the crisis, while another 40% have managed to keep it unchanged – an impressive achievement under the circumstances. Incidentally, many are not yet sure where they stand, while only 6% report a loss of position.

According to Patrick Siebert, managing director of corporate transformation services at Alvarez & Marsal and co-head of the company’s German practice, customization is the secret sauce for this robust achievement.

“If everything changes, the supply chains no longer work, production partially comes to a standstill and established sales channels collapse, the losers are those companies that cannot fundamentally change,” said Siebert.

In fact, two thirds of all companies surveyed state that they made adjustments in their company in response to the crisis, which explains the large proportion of “winners”. Where do the industrial companies make these adjustments? The answers vary and reflect the widespread impact of the crisis.

Adaptation to market changes

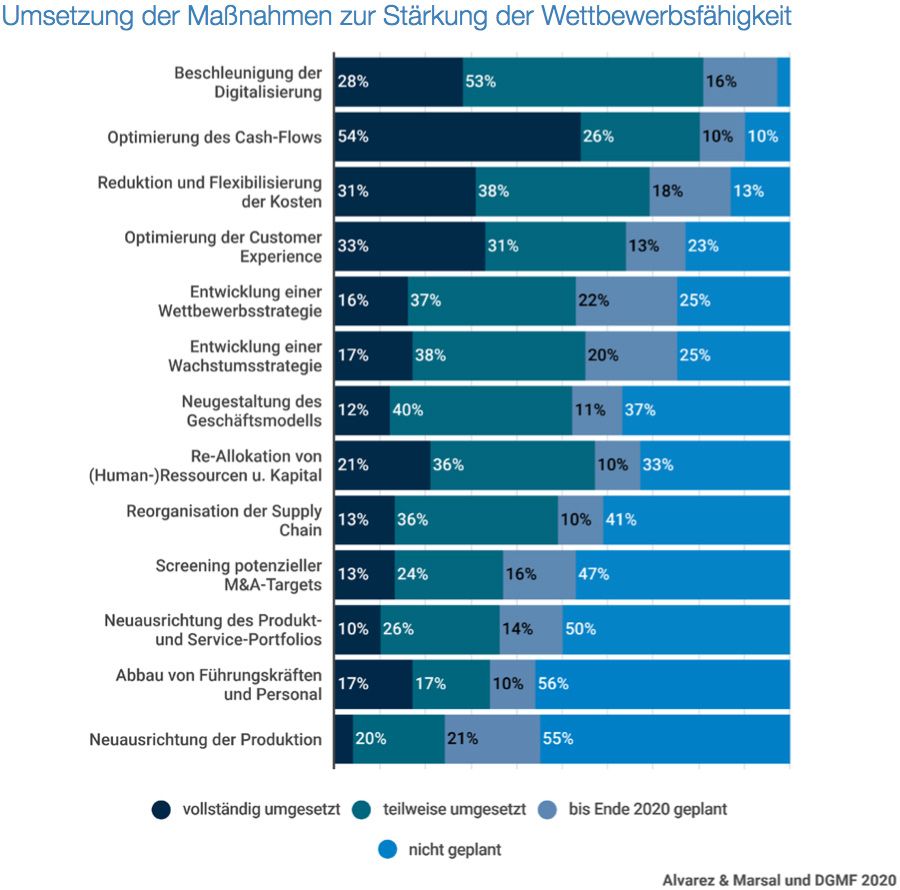

The immediate instinct was survival. Revenues dried up immediately after the outbreak, lowering any business hopes for liquidity. The answer: Optimizing cash flow is the most commonly implemented strategy among respondents. 80% have made some progress while more than half have fully optimized cash flow. Almost a third has also reduced its cost base and made it more flexible, another 38% are still in the works.

Another response to pandemic-induced market changes: a third of industrial companies have implemented strategies to optimize the customer experience – as they compete in a market with low spending and changing preferences.

With these immediate answers, it’s time to look ahead. “In many cases, operational adjustments had to be made immediately to ensure continued existence. Strategic and tactical changes are now required in order to consolidate the positioning in the medium and long term, ”said Phillip Ostermeier, Managing Director at Alvarez & Marsal in the Corporate Transformation Services division.

Digitization is at the center of the future. Almost 30% of companies have accelerated their digital transformation journeys since the pandemic – in response to virtual work agreements and the demand for a digitized customer journey. Another 53% are still working on this acceleration, which is due to the need for strong positioning in the new normal.

Other long-term adjustments include redesigned business models, reorganized supply chains, and increased merger and acquisition activity to support the business restructuring. “The appetite of market participants for M&A, both in companies and in private equity, is growing significantly again,” said Jürgen Zapf, Co-Head of Alvarez & Marsal Germany.

So companies are in a good place and are continuing to adapt. For Ostermeier it is now the goal to avoid the trap of change for the sake of change. “It is important to distinguish between meaningful, because sustainable, changes on the one hand and actionism on the other.”