Household companies effectively positioned to steer financial revival

The unique structure of family businesses that has enabled them to respond more successfully to the negative impact Covid-19 is having on their business, according to a new report. Downsizing in family businesses was almost 2% lower than in non-family businesses as they wanted to try and double the digital and ESG transformations in response to the crisis.

Family businesses are an important pillar for sustainable economic growth that is geared towards generating long-term value for future generations. According to a new study, the unique structure of many family businesses has also positioned them well to adapt to the negative impact of the coronavirus on their trades.

The study carried out by KPMG Private Enterprise in collaboration with the STEP project for family businesses took into account the opinions of 2,500 family businesses worldwide and compared them to over 500 non-family businesses. It found that despite the wide variation in the size and makeup of family businesses, the common factor was a longer-term mindset that led to a high level of resilience when faced with one of the greatest challenges of modern times.

Tom McGinness, Global Leader, Family Business, KPMG Private Enterprise, stated, “For many family businesses, an unexpected and positive outcome from the pandemic has been the gift of time. With their business slowing, several family business executives found that they now had time to explore ideas for new products, new markets, and expansions to their business that had been considered for several years. Others took the time to seriously look for ways to streamline their operations, including implementing new digital solutions, and focus on important family issues like succession planning and their ownership structures. “

While the vast majority of family businesses saw a decline in sales, many were able to pivot their businesses to avoid the worst effects of the pandemic. This is an example of how 69% of family businesses saw a decline in sales, 9% saw an increase due in particular to measures to align their business, and 22% reported no changes in sales. As a result, the average decrease in the workforce for family businesses worldwide was 8.56% versus 10.24% for non-family businesses.

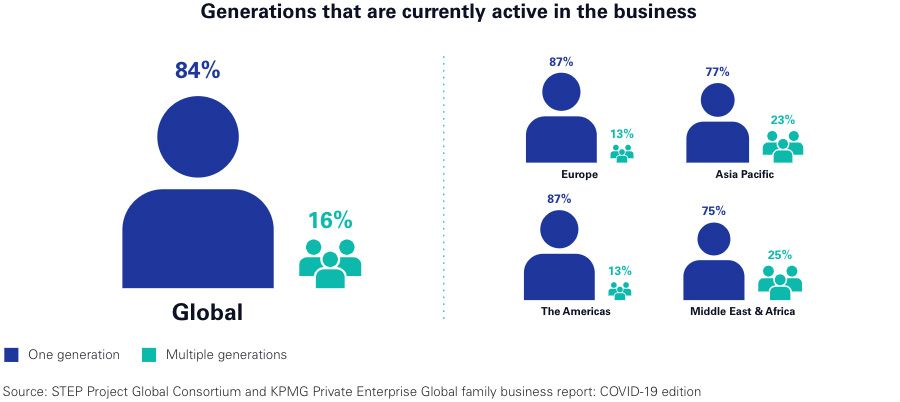

The study also revealed the central role that several generations of the family played in their response to Covid-19. When two or more generations of the family were involved in the company, the study found that next-generation family members helped advance two key goals: rapid digital advancement and promoting ESG efforts on the agenda. As a result, it was found that family businesses were 42% more likely to implement business transformation strategies than non-family businesses during the pandemic.

The drive to change as a result of last year’s crisis has left many family businesses well positioned to stay ahead of any future economic recovery. According to the study, around 70% of families said they kept their R&D investments and continued to bring new products and services to market throughout the pandemic.

Jonathan Lavender, Global Head of KPMG Private Enterprise, commented, “The pandemic opened up the opportunity for young, tech-savvy family members to take on prominent roles in adopting digital technology solutions that streamlined their business operations and brought a variety of new products to the market. These NextGen influencers also realized that implementing an ambitious ESG strategy is an essential part of transforming the family business. As a result, they have accelerated the operational changes needed to achieve their organizations’ environmental and social goals and firmly anchored ESG as a strategic business priority. “

However, not every family business was positioned to benefit in the same way. KPMG found that 84% of global family businesses currently only have a single generation active, while that climbs to 87% in Europe and America – potentially hindering their recovery. One generation family businesses were 45% less likely to have corporate transformations than two generation businesses.