Enterprise College Briefing: MBA webinar, McKinsey turmoil, dispute decision

Welcome to the Business School Briefing. We offer insights from Andrew Hill and Jonathan Moules as well as the selection of the top stories that are read at business schools. Edited by Wai Kwen Chan and Andrew Jack.

Notice board

Free Webinar: Secrets of Successful MBA Applications

Recommended

Are you wondering if and where you should study for an MBA? Do you have any questions about how you can stand out from others in your application?

Ask our panel of experts with admissions officers from Insead, London Business School, Chicago Booth, and SC Johnson Graduate School of Management at Cornell for advice from a senior GMAC official, as well as a recent graduate and recruiter. Click here to register for free.

What do chief learning officers want from business schools? We are looking for the opinion of CLOs on management training – share our questionnaire with your networks.

Andrew Hills Management Challenge

“Trouble on Mount Olympus”, as it is called in the editorial team of the FT, is the big management story of this week: McKinsey, the contested consulting firm that is at the height of the industry, is suffering from leadership turmoil. Kevin Sneader, the current global managing partner, was unable to win re-election after suffering a series of blows to the company’s reputation.

Recommended

As I’ve written, partnerships are difficult at best, which requires a subtle combination of authority and (not too much) power. For my Management challengeHere is the question the FT editorial tried to answer: What should McKinsey advise McKinsey? Send your precise strategy (no PowerPoint decks please) to [email protected].

In further reading, a compelling profile of Shopify, Canada’s Most Valuable Company, by Sean Silcoff of The Globe and Mail. He paints an interesting picture of the idiosyncratic and occasionally aggressive management style of co-founder Tobi Lutke. The independent retailer e-commerce platform is starting to worry Amazon, but Lutke rates his company this way: “I know it works well, but it’s still horrible. It can get a lot better. “

Jonathan Moules’ messages from the business school

Dispute settlement classes are growing in popularity and have helped an MBA graduate survive a life or death situation, as I write in this article: Negotiating Skills Prove Their Real Value.

Recommended

I recommend a few this week keep listening: A discussion on the business case for diversity between David Thomas, Professor Emeritus at Harvard Business School, his colleague, HBS Professor Robin Ely, and Katherine Klein, Vice Dean of the Wharton Social Impact Initiative.

They emphasize the benefits of a diverse and inclusive workplace, but say it is too easy to replace white male employees with women and employees from traditionally underrepresented groups that doesn’t translate into real change or improvement in financial performance. Inclusion strategies need to go much deeper.

Data line

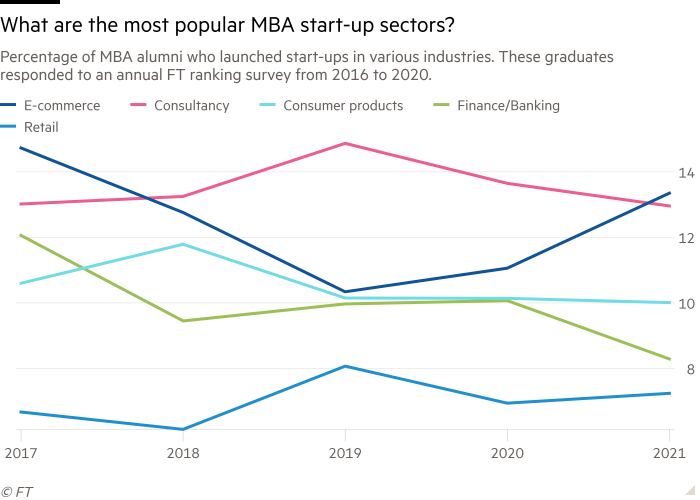

According to an FT survey, almost every fifth MBA alumni has founded their own company since 2017, writes Sam Stephens. The most popular industries in which graduates set up startups are consulting and e-commerce.

Over the past five years there has been a steady decline in MBA alumni building a finance / banking business. The alumni surveyed in 2020, the data point 2021, were asked whether their company was affected by the coronavirus pandemic. The sector hardest hit was retail. Almost a third of the companies founded by alumni in this branch were affected.

Further analyzes of the MBA alumni entrepreneurs can be found here.

How well do you know the news?

Answer our 10-question quiz.

Top business school reads

Warren Buffett warns of a “bleak future” for debt investors. “Bonds are not the place these days,” the Berkshire Hathaway head told shareholders in his annual letter

The Nasdaq is down 3.5% as government bonds accelerate. Tech stocks have their worst day since October, as 10-year government bond yields surpass 1.5%.

“It has to change its culture”: is McKinsey losing its mystique? The managing partner Kevin Sneader wants to close the “dark chapter” of an opioid scandal, but has to rebuild trust in the company

Previous editions

To view previous newsletters, go to: ft.com/bschool.

Register for the FT Business School Briefing.