Companies conduct beneath elevated scrutiny attributable to pandemic

With companies and governments under public scrutiny during the pandemic, more than eight in ten companies expect investigations into their business operations in the coming year. Watchdog research is expected to focus on the key areas of business conduct, sustainability, and government procurement.

The social inequality exposed by Covid-19 creates an unforgiving marketplace with companies controlled by governments and the public and little room to avoid disputes and investigations into business practices and conduct. For example, the UK government had already come under fire for spending on private consultancy firms in August 2020 after it was revealed that the industry had won £ 56m in contracts to help with the national response to the coronavirus. While that number – and the associated criticism – has continued to rise since then, new controversies are still surfacing around these first awards a year later.

At the same time, public awareness of the looming climate catastrophe – and the role of common corporate practices that have exacerbated them – has increased the scrutiny of sustainability practices across all industries. As the pressure mounts, the investment sentiment model suggests that many companies will find themselves in financial trouble due to public scrutiny – and 80% of investment managers now believe companies with no sustainability risk in the supply chain will lose their share price.

As suspicions of corporate and government practices continue to ferment, a new study by FTI Consulting has shown that a large majority of companies now expect to be publicly investigated in the next 12 months. The survey of more than 2,800 executives of large public and private companies from the G-20 found that 83% of these organizations have either been investigated or are expected to be investigated during this period.

According to the FTI, the top three investigative concerns were: business conduct and customer dealings; Sustainability and ESG practices; and the relationship with public authorities and public contracts. A third of respondents identified each of these areas as their primary concern.

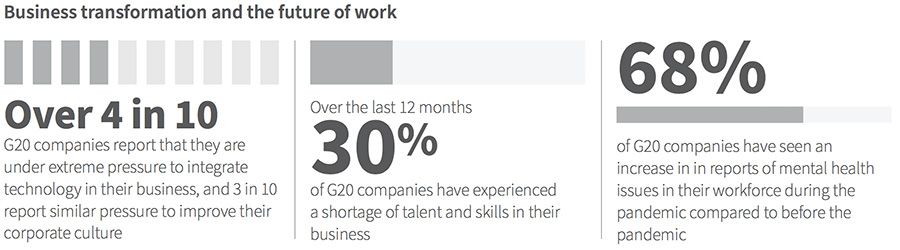

In response to these fears, companies are trying to proactively protect themselves from future audits. The report found that 41% of companies felt they were under “extreme” pressure to incorporate technology, 37% were pressured to strengthen their reputations, 34% expected sustainability practices to improve, and 29% wanted to improve Corporate culture in the next 12 months.

Caroline Das-Monfrais, Senior Managing Director and Global Resilience Lead at FTI Consulting, said: “Covid-19 has exposed and exacerbated economic and social fault lines – employee wellbeing, talent shortages, customer handling, financial crime and cybersecurity all have risen up the corporate agenda, and companies are responding to protecting value and building resilience as they look to future growth. “

In addressing these concerns, however, firms are not positioning themselves solely to avoid investigation. They may also be better able to handle a number of crises resulting from the coronavirus outbreak.

For example, growing cybersecurity threats could be addressed through better integration of technology – as 78% of the companies surveyed had been hit by a cyber attack in the past 12 months. Meanwhile, by improving the way they treat customers and their reputation, the 13% of businesses that have seen class and mass lawsuits from consumers in the past year can improve their ability to attract and retain consumers. And the 30% of companies that now complain of a lack of talent and skills, or the 68% that are experiencing increasing mental health problems in their workforce, can attract and retain more productive employees by improving their corporate culture.