Amazon ‘roll-up’ companies increase billions in combat for ascendancy

When the Covid-19 bans fueled record growth in e-commerce in the final months of 2020, a new breed of online retailer began to attract investors.

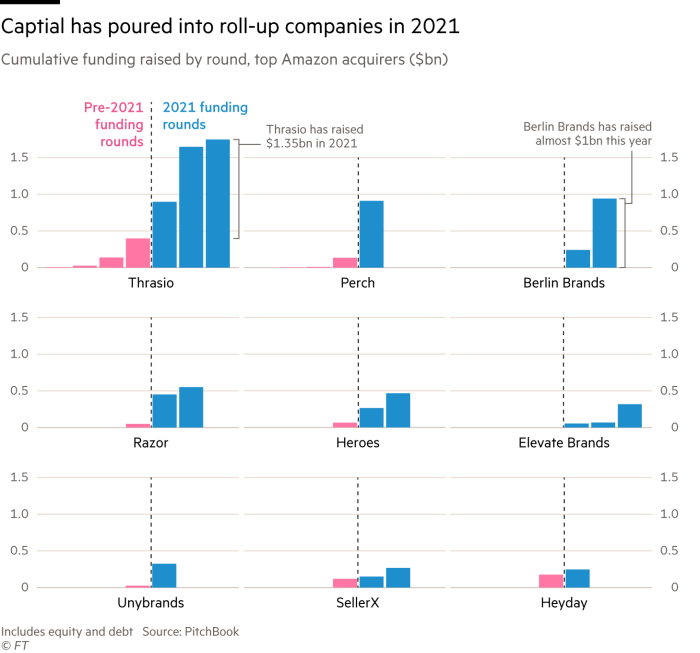

A handful of e-commerce “aggregators,” led by Massachusetts-based Thrasio, had raised $ 1 billion by the end of the year to buy up the most successful independent retailers on the Amazon marketplace.

At that time, a billion dollars appeared like a lot of money. But just nine months later, dozens of similar-looking Amazon rollups have raised more than $ 8 billion to date, according to Marketplace Pulse, which is tracking the sector.

Just this week, three Amazon-focused companies in Europe announced that they had raised $ 1 billion in a single day. This included $ 700 million in debt and equity for the Berlin Brands Group in a deal led by Bain Capital that valued the German company at more than $ 1 billion.

“Everyone is wondering if there is enough space for so much money. The short answer is yes, “said Peter Chaljawski, founder and managing director of BBG.” We see that our inbound and funnel [of potential merchant acquisitions] is extremely full. “

Of the millions of sellers who have set up a virtual shop on the Amazon marketplace, buyers see tens of thousands with buyout potential: making profitable products with many five-star reviews that sell more than $ 1 million a year.

Even obscure niches, from sex toys to doorstops, can grow into big corporations on a platform that Marketplace Pulse estimates had sales of $ 300 billion last year.

2020 was an unusual year for anyone selling anything online. Some of Amazon’s largest markets, such as the US, UK and Germany, have reopened their main streets after closings, sending shoppers back to physical stores. UK online retail spending has fallen about 40 percentage points since non-essential stores reopened on April 12, according to Fable Data, which tracks credit card transactions.

“At the beginning of the year everyone had their best year ever,” said Taliesen Hollywood, director at Hahnbeck, a boutique M&A consultancy with a focus on e-commerce deals. “Now people don’t buy that much online and the growth is nowhere near as strong.”

This has helped stabilize the prices buyers pay for sellers despite the cash inflowing sector. After the aggregators were “desperate for deal flows” in early 2021, “they are becoming more selective and saying no to a lot more deals,” Hollywood said.

Amazon marketplace businesses are typically valued at a multiple of the “seller’s voluntary profit,” which adjusts a more standardized profitability metric – earnings before interest, taxes, depreciation, and amortization – to include certain costs such as marketing, legal advice, and salaries that make up the Acquiring company is expected to operate in-house. In recent months, traders have typically sold for around four to five times the SDE.

“Many have increased, but they are still at a level where it makes sense,” said Philipp Triebel, co-founder of SellerX, another Berlin-based Amazon aggregator that raised 100 million euros in new equity last month. “You are not seeing the same growth as last year, but no one would bet against e-commerce as a sector.”

Some product categories like home fitness or gardening tools have suffered more than others this year, but aggregators with a number of retailers in their portfolio believe they can make it through the ups and downs.

“We buy companies for certain multipliers and our business is valued significantly higher because of the synergies and diversification,” said Riccardo Bruni, co-founder of Heroes, a UK aggregator that raised $ 200 million this week.

The hope is that after acquiring several such companies, making their supply chain or marketing more efficient, and expanding into new markets, the collection from dealerships will be worth more than the sum of its parts.

For example, Bruni said that thanks to its supply chain connections in China, Heroes was able to cut the unit price for one of its acquired dealers from $ 7 to $ 5.50 within days of closing the deal.

Still, many of the companies operating in this sector are barely a year old, which means that few have set a record that proves that they can reliably implement this concept for efficiency and synergy.

In the short term, this makes the financing of your acquisition tours more expensive. These aggregator startups have turned into debt to raise such large sums of money quickly by hiring lenders rather than the venture capitalists who typically fund young tech companies with equity.

“The reason we have access to debt and see all these big fundraising is because we end up buying profitable companies,” said Giancarlo Bruni, who co-founded Heroes with brothers Riccardo and Alessio. Compared to his previous position in corporate finance at telecom consolidator Liberty Global, Heroes has to pay “significantly higher interest rates,” he added.

Nonetheless, Amazon’s marketplace is industrializing almost as quickly as the roll-up outfits can raise capital. Dozens of specialist brokers have sprung up over the past year to help dealers find buyers, as well as a small army of trademark attorneys, accountants, and other advisors.

“In the last few months [M&A] Process is mature, ”said Ollie Horbye, co-founder of Olsam, another UK aggregator that raised $ 165 million this week.

“Bringing our funding to the public gives sellers we have never met before more confidence in Olsam and our ability to close [a deal]”Said Horbye. “There are a long line of buyers in this area. The deal flow is focused on the better-known, larger players. “